Products

CMT’s suite of risk, claims, engagement, and video telematics products help you attract more customers, reduce costs, and create a delightful experience for your customers.

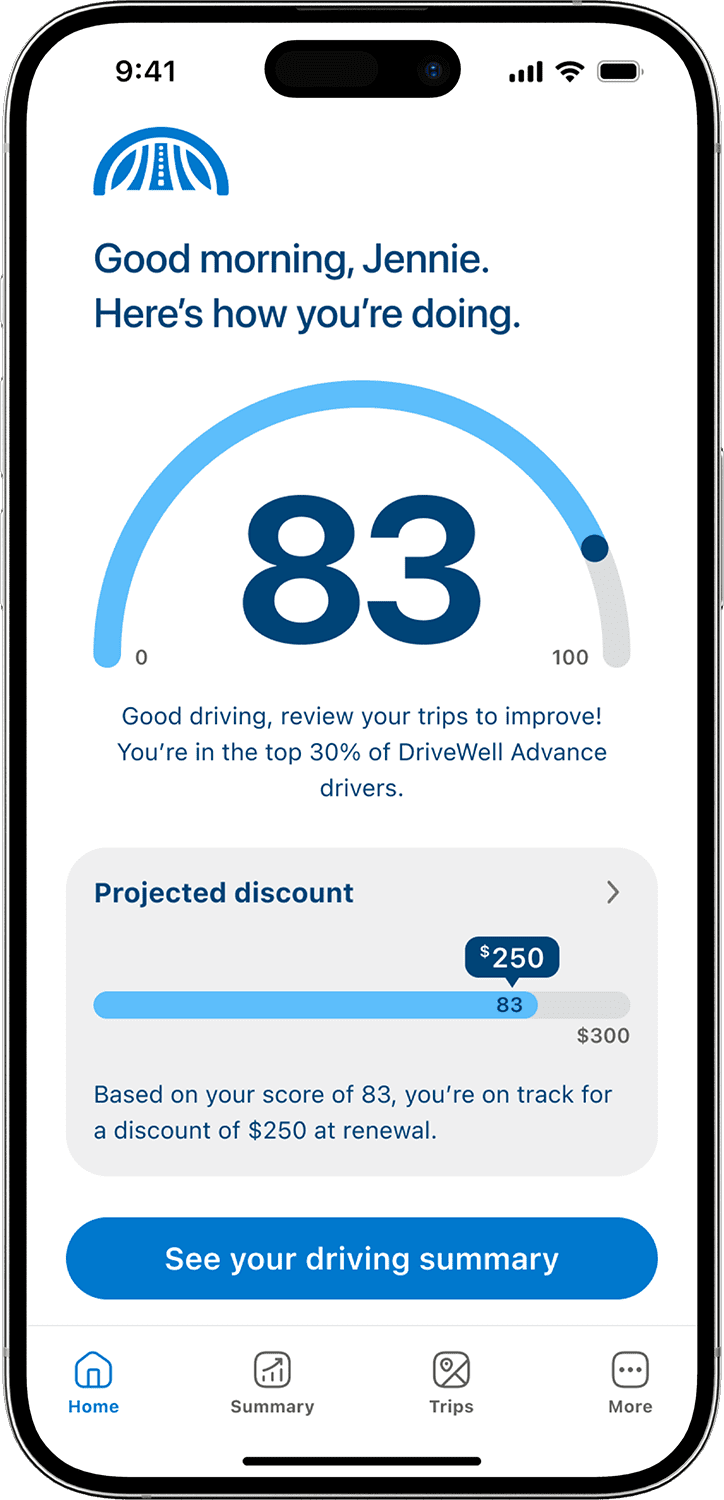

DriveWell Risk

DriveWell Risk is a complete telematics and behavioral analytics solution to assess and improve driver behavior.

Benefits & Products:

See the details

Accurate Pricing

Identify the riskiest & safest drivers

Better underwriting

Receive accurate assessment of driver risk to support loss prediction and pricing.

Proven risk factors

Determine premiums with scoring models based on millions of trips and billions of miles.

Lower Losses

encourage safer driving

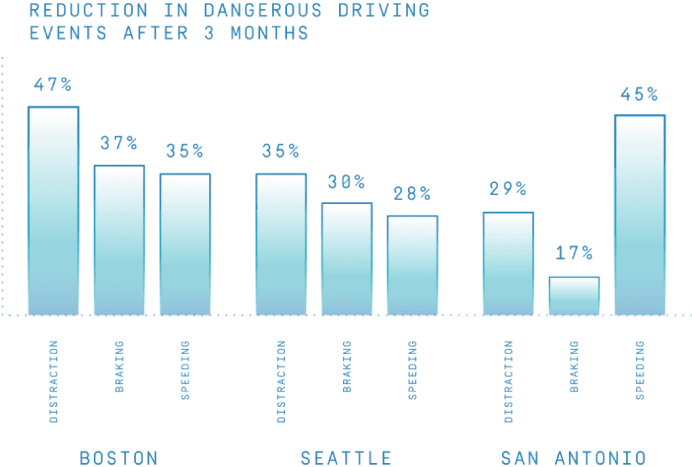

Actionable insights

Provide drivers frequent and personalized feedback on behaviors they can improve.

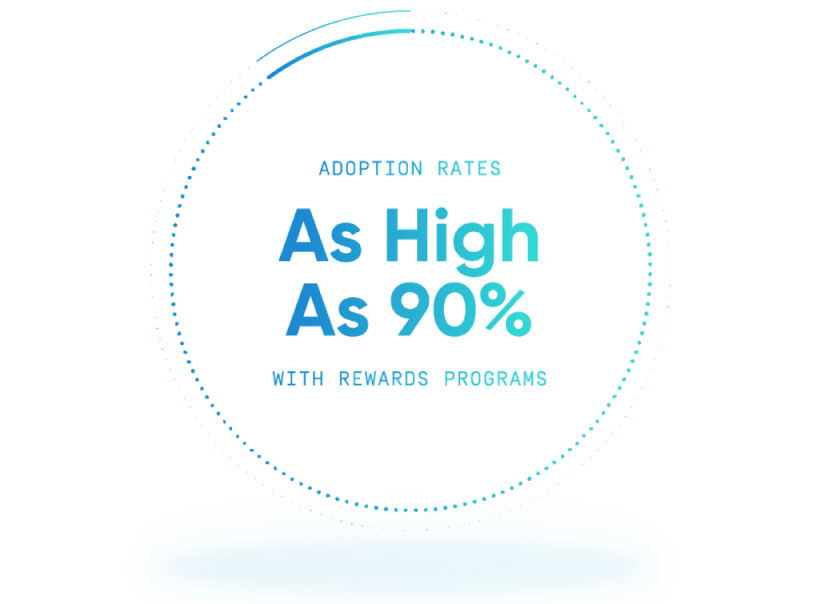

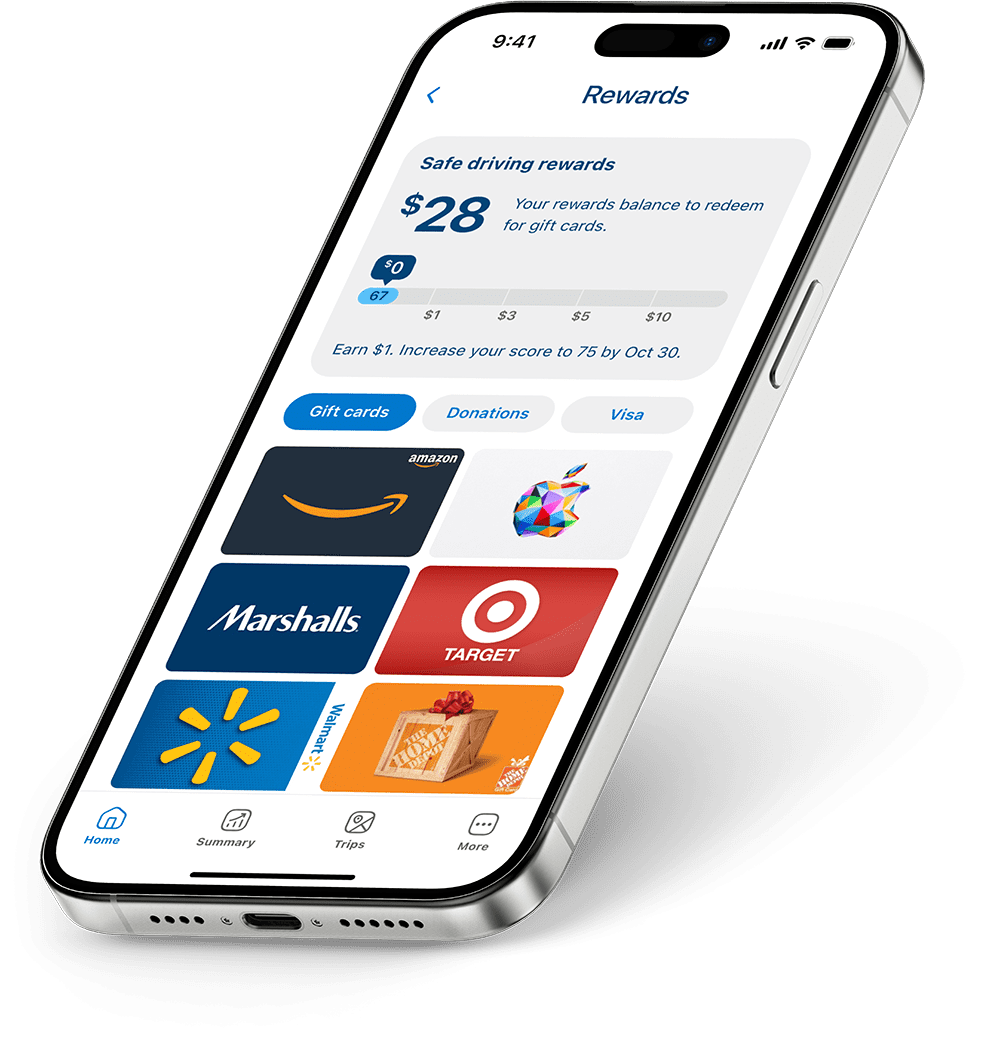

Rewards

Incentivize long-term improvements with a turn-key, customizable rewards program.

Customer Loyalty

Retain Safer Drivers

Postitive touchpoints

Create more positive customer interactions with incentives like discounts and rewards.

Engaging apps

Keep your drivers excited with features like Family Sharing, competition, badges, streaks, and more.

DriveWell Risk Products:

Premium Score

Measure driver risk with scoring models based on millions of trips and billions of miles.

DriveWell Fleet

Reduce costs for fleets and commercial insurers with a lightweight driver improvement solution

See the details

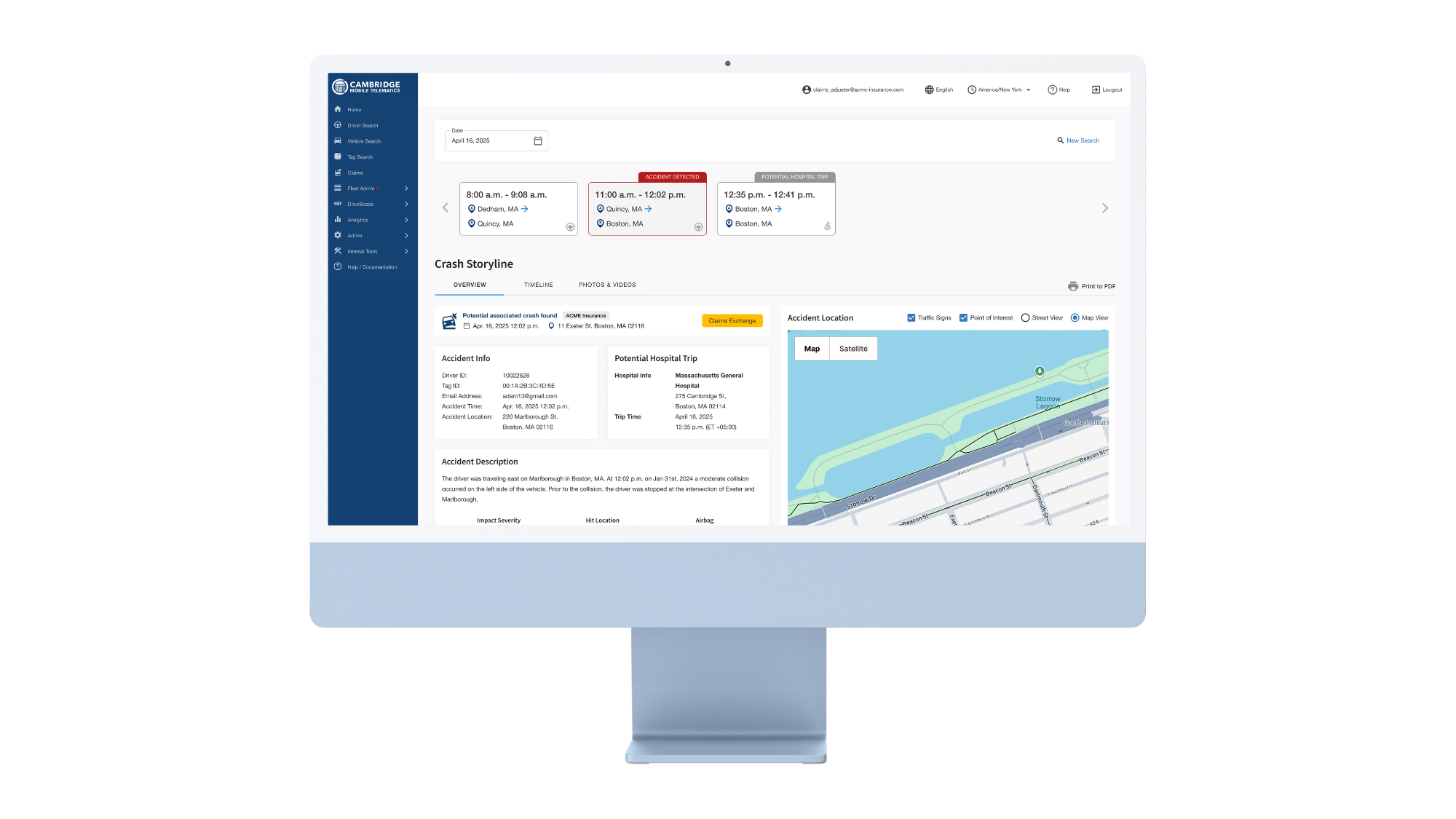

DriveWell Crash & Claims

DriveWell Crash & Claims detects car crashes and sends help in near real time, drives digital adoption, and unlocks proactive claims and automation.

Benefits & Products:

See the details

Reduce cycle time

Know a loss occurred in minutes. Proactively contact your customer.

Increase Digital FNOL submissions

Telematics prefill data helps customers complete submissions.

Reduce FNOL call time

More data means less time asking questions.

Reduce first adjust contact calls

With crash data at their fingertips, adjusters can focus on confirming key information.

Settle claims with coverage flags faster

Confirm critical information about the claim with telematics data.

Faster, better liability investigations

Get accurate ground truth data from the crash scene. Know the date, time, location, and severity.

Streamline investigations

Telematics data gives you ground truth data fast. So you can pay the accurate amount sooner.

Quick liability investigations

Use telematics data for better and more timely subrogation.

Faster, more effective triage

Match adjuster experience with claim complexity.

Use the right adjuster for the job

Telematics data helps you triage claims faster. Know with more precision when to call the total loss and injury teams.

Faster, more effective total loss decisions

Know crash severity and point of impact based on year make and model.

22% of claims are total losses

Know if it’s a total loss with confidence. Get the salvage value quickly. Avoid multiple tows. Funnel total losses directly to salvage.

$600 per claim

Save $600 per total loss by reducing advanced charges like storage, secondary tows, and rental days.

Reduce legal & medical run-up costs

Proactively address potential injuries at the time of loss.

Reduce unnecessary attorney representation

Better understand and address customers’ needs fast.

Identify complex claims

Triage complex medical and legal issues to the best handling options.

Faster fraud identification

Know the facts early in the claims process and identify unusual activities.

Faster resolutions

Use telematics data to acceleration resolution and payment to customers.

DriveWell Crash & Claims Products:

DriveWell Crash

Detect car crashes in real-time. Send emergency and roadside assistance to your customers. Provide peace of mind.

DriveWell Claims

Make your claims operations more effective and efficient with telematics data.

See the details

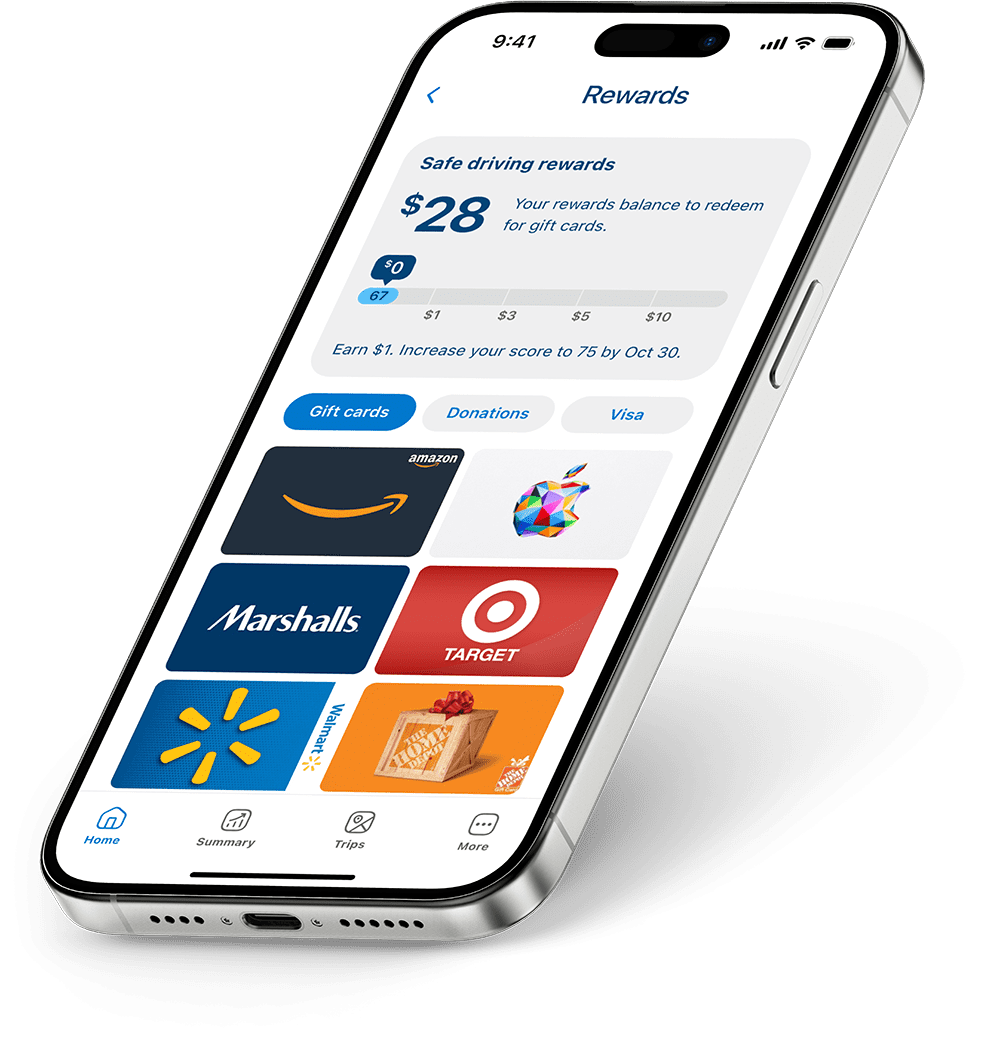

DriveWell Engage

Create safer drivers and build brand loyalty with proven app engagement.

Benefits & Products:

See the details

Motivate Drivers

Design your app to connect with multiple driver segments

Offer incentives for safe driving

Drivers earn points for safe driving that can be redeemed for gift cards. Touchpoints with drivers are frequent, creating a feedback loop that promotes long-term engagement.

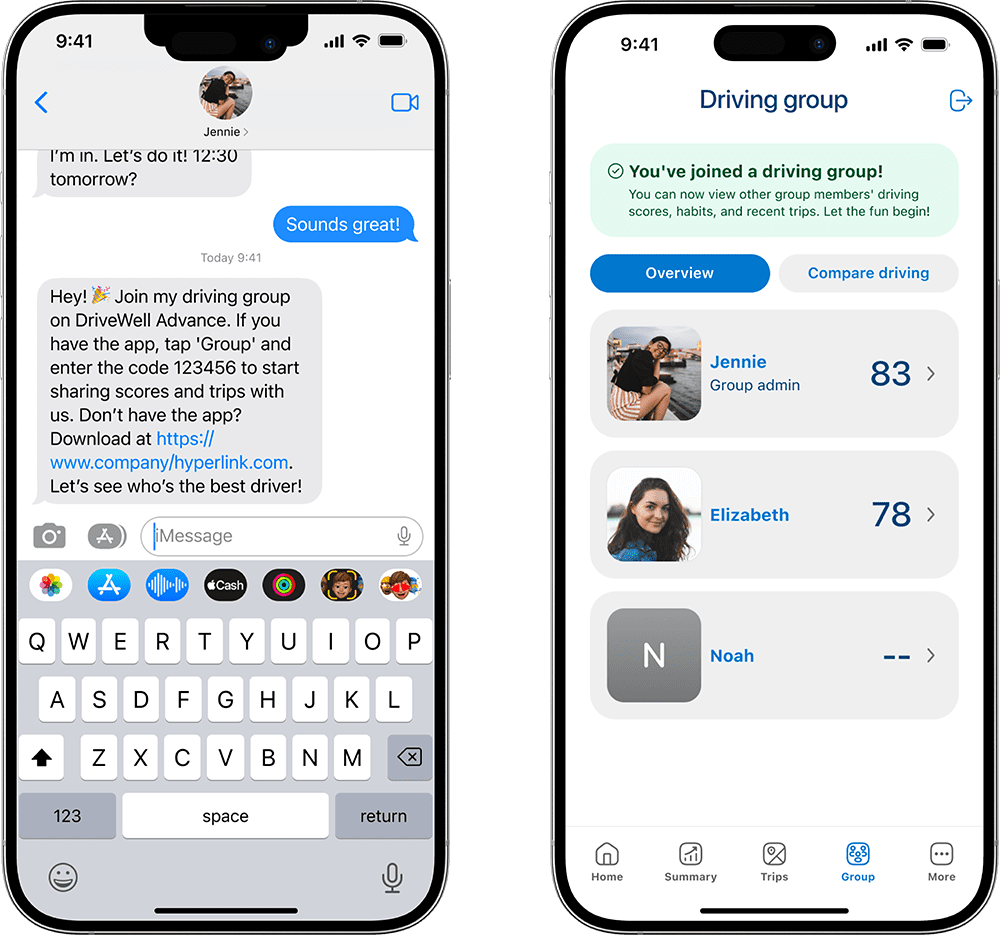

Encourage safe driving for families and teens

The Family Sharing feature provides parents and young drivers with real data to help coach and motivate each other to drive safely.

Retain Drivers

Create meaningful touch points with your customer beyond claims and renewals

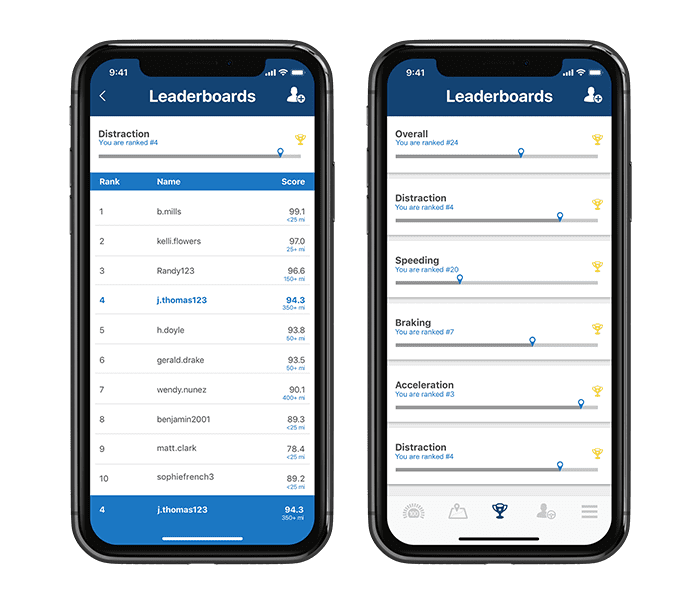

Enable friendly competition

Safe driving becomes a team sport with Leaderboards, where drivers can see how their scores rank compared to others on the program.

Improve Drivers

See fewer and less-severe claims across your book of business

Give actionable feedback on driving behavior

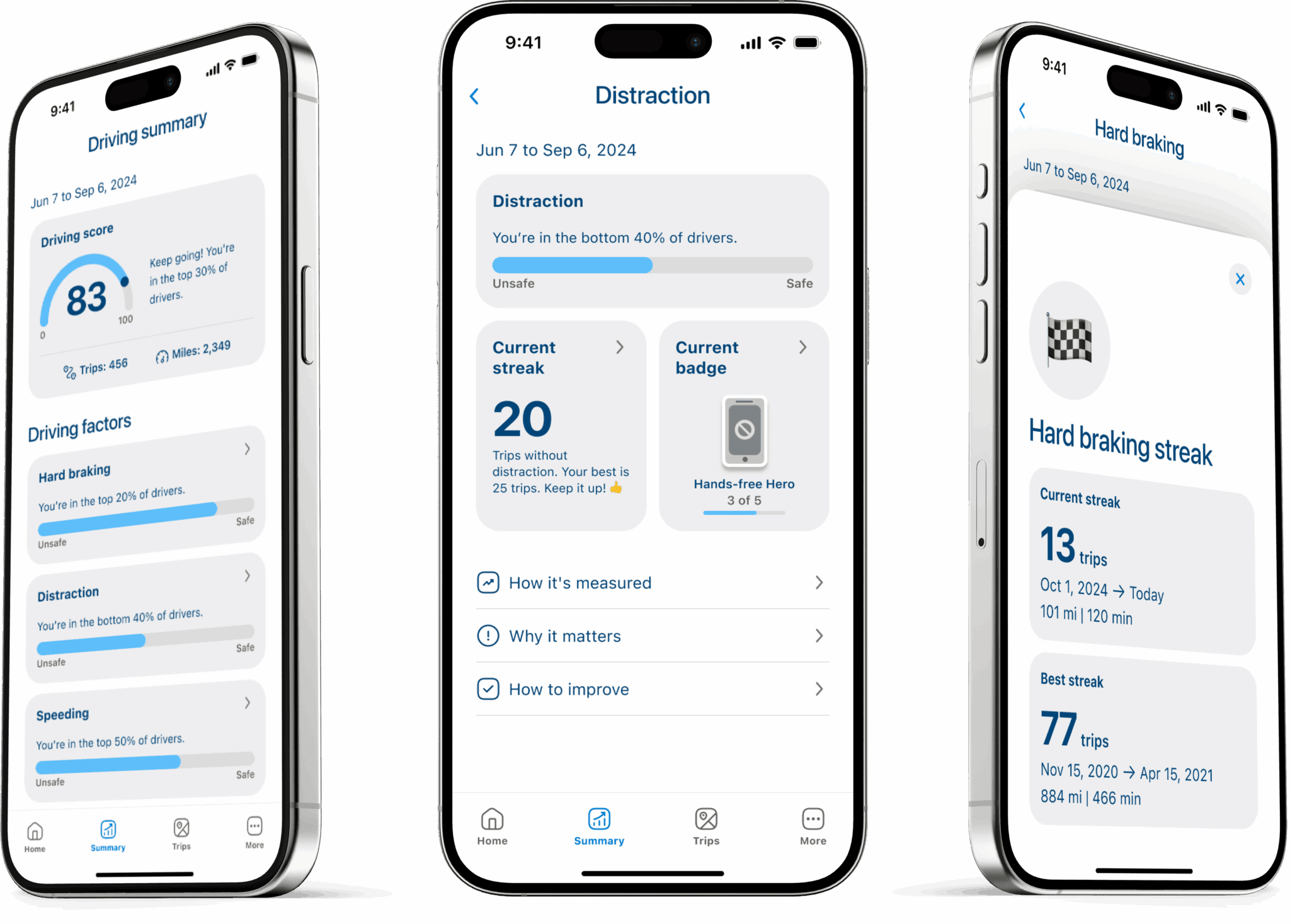

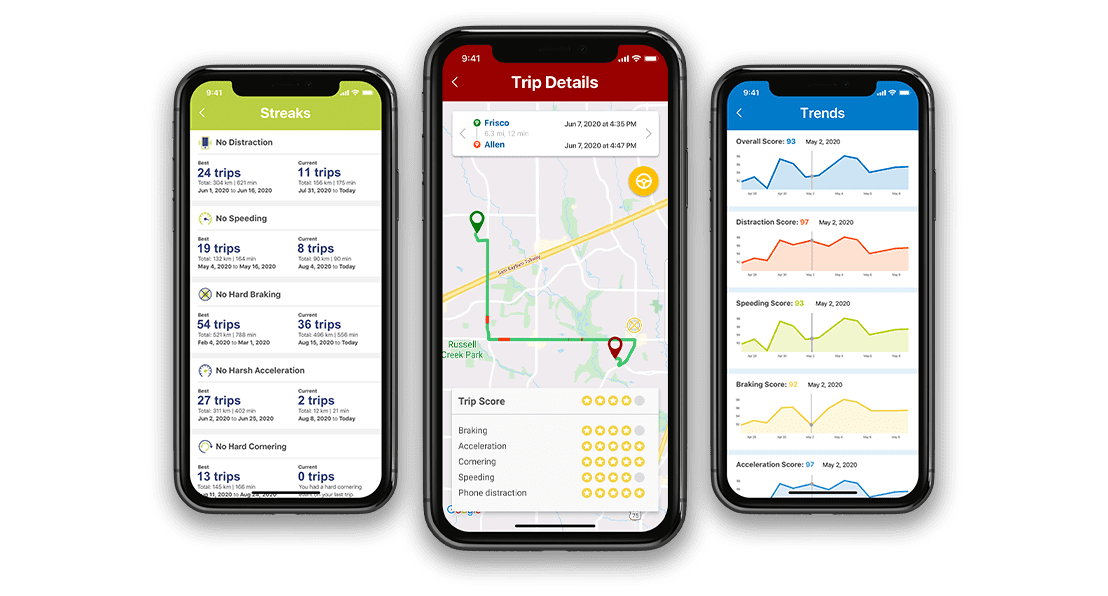

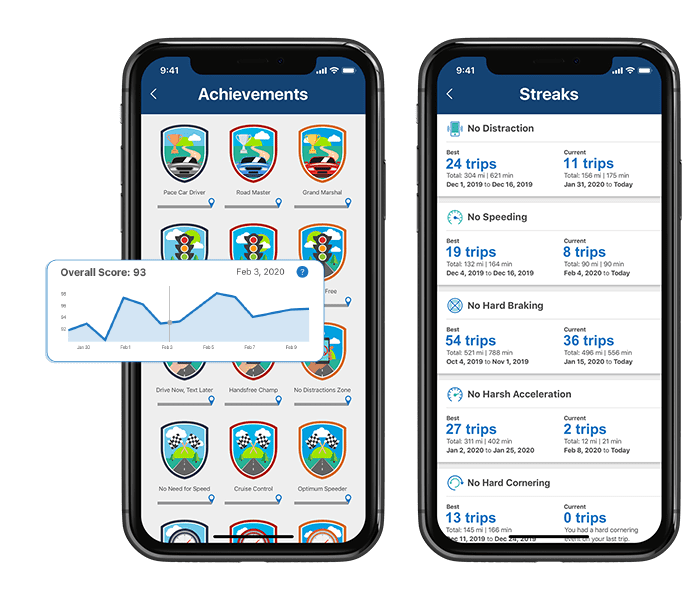

Drivers receive an at-a-glance view of their trending driving score, plus star ratings for each trip and risky event.

Celebrate driving improvements

With insights and milestones like Trends, Streaks, and Achievements, drivers can see their behavioral improvements over time.

See the details