COVID-19 has Changed Drivers' Expectation of Insurance, but What Product do They Want?

In January 2020, CMT ran a survey with drivers from four countries in Europe to ask about their experience with and attitudes towards connected insurance. In September, we ran the same survey, again conducted by an independent agency with 2000 drivers in France, Germany, Italy and the U.K. The answers gave us a unique look at the impact the COVID-19 lockdown had on driver behavior and their opinions of the car insurance market.

The survey showed how the lockdowns changed driving patterns and increased interest in Connected Insurance products.

Appetite for various types of usage based insurance (UBI) models increased sharply since the pandemic started in Europe: In January 2020, 49 percent of European drivers suggested they would be likely to try UBI of any kind. Nine months later, 65 percent of the population were likely to make the switch.

In terms of the value proposition and pricing models, the survey gave the choice between several models along four core types:

- Distance-based insurance, using a subscription and a fee per mile or a pre-paid mileage allocation

- Behavior-based insurance with different sets of discounts and cashback based on how people drive

- Reward insurance with recurrent non-monetary rewards based on driving behavior

- Try-Before-You-Buy using an app to quote based on the driver’s score during a predetermined period

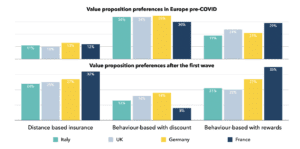

Some of these models are not as well understood or recognised in Europe, but the differences between the two surveys were very clear: there is a huge shift away from “old school” discount-based telematics (-58 percent) to Pay-As-You-Drive (+145 percent) models.

The biggest shifts are seen in the U.K. and France, where the attraction of distance-based insurance has nearly tripled since the beginning of the pandemic.

In the U.K., the second choice overall was the Rewards model, which was also Italian drivers’ second most picked option. In both countries, 33 percent of the Gen Z drivers picked that model. These are markets with strong historical discount offerings – especially for young drivers – and the two biggest markets by volume in Europe. One possible explanation could be that teen drivers may not be paying for their own premiums anyway and would be more motivated by rewards for safe driving.

Alongside the recognition that telematics can make insurance fairer and more personal, drivers would be willing to pay monthly fees for certain additional services. Safety-related options such as extra rewards for safe driving and emergency roadside assistance are at the top of drivers’ wish list.

Emergency response was the biggest request in France (34 percent) and Italy (43 percent). In those countries, the request for assistance with claims processing was also high on the list (38 percent in Italy and 26 percent in France). There were variations between segments; the full report gives detailed insight into what service entices specific drivers.

Download the new report on Insurance Value Propositions here.