Insurers in Europe Need a New Story to Tell

2021 will not be business as usual; massive societal change means car insurers need to find new value propositions in order to adapt to drivers’ changing expectations and updated risk profiles.

In January 2020, CMT conducted a survey with 2,000 drivers from Italy, France, Germany, and the UK – weeks before COVID-19 became an international crisis. CMT ran the same survey again with a different set of drivers in September, granting a great look at how the pandemic and subsequent lockdowns have impacted driving behaviors in different ways throughout Europe.

Up to 81% of drivers have changed how much they drive because of COVID-19 in the four countries surveyed. The pandemic has also modified commuting patterns and the average drivers now on the road are much riskier – there are far more young drivers driving without other viable commuting options.

At the same time, the September survey identified how drivers have become more enthusiastic about the connected insurance concept and how many have actually acted already.

An average of 3% of drivers have made the switch to telematics in the last six months. The others are overwhelmingly likely or very likely to switch at the next renewal if the offer is present. Italy is still in front with 74% of the respondents positive about switching to UBI. The U.K. and France are now equal at 63% of the respondents ready to switch. Germany grew from 47% to 58% of respondents willing to switch.

While the attractiveness of connected insurance increased throughout Europe, each country lockdown impacted drivers differently. In the U.K., 66% of the respondents said their driving patterns changed and that they are now driving less. 29% also noted that they drive for different reasons, and on different days.

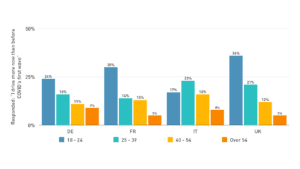

In France, however, the majority (57%) have not really changed driving habits, 12% even suggested they drove more. An explanation could be linked to the fact that there and throughout Europe, 30% of the young drivers said they drove more during lockdown suggesting a switch from public transport to private vehicles.

Changing behaviors bring tailwind to Try Before You Buy

Confinement also means people are more inclined to be researching for better policies via online channels, which is now the prime method for up to 63% of the drivers in this survey. At the same time, most drivers are now spending more time evaluating insurance offers, especially Frenchs and Italians.

In terms of getting an insurance quote, the majority of respondents chose one of the various digital channels in three of the four countries (75% in the U.K., 54% in France, and 60% in Germany). In Italy, only 40% of respondents chose the digital channels, the lone outlier. The preferred method there is still based on a personal relationship with agents or brokers, however the percentage dropped from 59% pre-COVID to 51% during post-first wave lockdowns.

Buying insurance via an app, including the Try-Before-You-Buy (TBYB) model, is still very much a novelty in Europe and few drivers seem to understand it fully, yet half the drivers choosing apps as a way to buy insurance chose the option to be scored in order to receive a fairer quote.

Yet the survey revealed drivers are not only more app-focused but also are more comfortable with the buying channel. The trend is even more evident after the first-wave lockdowns; the population interested in this model grew by 30% in France and Germany, and by 115% in Italy.

Commuters are using their vehicles differently and there is no clear indication of if or when things will return to normal. As a result, they are now much more aware and interested in connected insurance value propositions. To find out more details about the demands, triggers and segments related to car insurance, download the new report on Insurance Value Propositions here.