New Report: Building Sustainable Auto Insurance

Sustainable insurance is a new concept with the power to drive engagement while reducing drivers’ carbon footprint. And fuel bills.

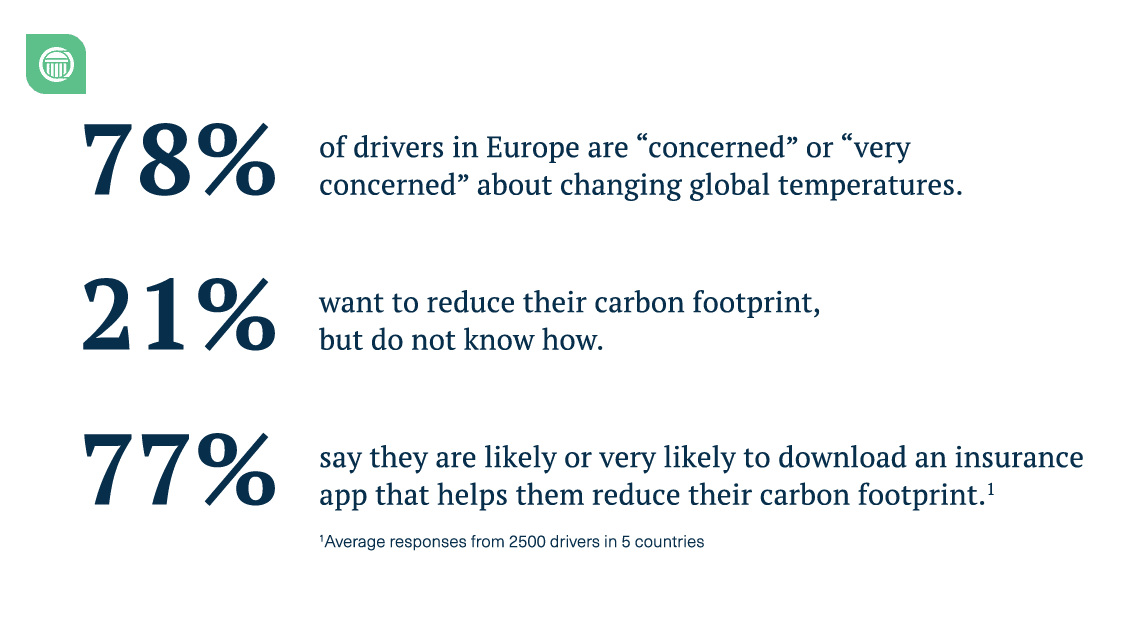

In an era marked by frequent natural disasters, including recent deadly floods in Spain, Greece, and Italy, alongside a relentless onslaught of wildfires, heatwaves, and storms, an overwhelming majority of European consumers are searching for solutions to reduce their carbon emissions. A recent survey conducted by CMT across five European countries reveals that 78% of Europeans are deeply concerned about the escalating global temperatures and climate breakdown. Nineteen percent express extreme concern.

Our survey showed that European consumers in the five countries surveyed — Germany, France, Italy, Spain, and the UK — are ready to embrace change, but require guidance. This trend is consistent across the board, where discussions focus on the nature of the climate crisis, but don’t provide practical solutions at the personal level.

Auto insurers can play a significant role in helping customers reduce their personal impact on the environment. CMT’s survey data shows that European consumers are hungry for individual solutions beyond the regulations that force auto insurers to account for and publish their carbon footprint.

Mobile telematics can play a critical role in auto insurers’ sustainability strategy. Driving makes up about 25% of the carbon emissions for the average European. A carbon optimization strategy focuses on making drivers more efficient. Eco scores enable auto insurers to build the programmes their drivers need and want to reduce carbon emissions and improve fuel efficiency. They are an immediate, actionable tool that reduces fuel consumption and carbon emissions.

European programmes powered by CMT’s Eco Score have already seen success. These programmes enable insurers to communicate to their entire book of business about a topic that matters deeply to them. As a result, these programmes are highly engaging and help combat customer attrition by providing value beyond safety and discount messaging. Nearly 20% of drivers in these programmes open the app at least twice a week. And top-performing drivers have reduced emissions by 30% and have saved €400 on fuel per year.

CMT’s new report, “Making Auto Insurance Sustainable,” offers European insurers a toolkit to build value propositions that will drive sustainable insurance. These propositions are centered on fuel efficiency and carbon footprint reduction — powered by telematics. The report highlights the needs and wants of European consumers and segments them into personas to help auto insurers develop more targeted value propositions and messaging. It looks at how auto insurers are leveraging eco scores today and the consumer response. It explores visualizations and mental models to help insurers better communicate how much carbon emissions customers produce. The report also highlights the new European sustainability regulations and proposes three models for sustainable insurance: Carbon avoidance, carbon optimization, and carbon removal.

Download the Making Auto Insurance Sustainable report here.