COUNTRY Financial® DriverIQ Gets a Major Upgrade with CMT’s DriveWell Advance

Enhanced app helps COUNTRY Financial policyholders drive safer

Cambridge, MA — December 3, 2025 — COUNTRY Financial® today announced a major upgrade of its safe driving program, DriverIQ, with the latest DriveWell Advance technology from Cambridge Mobile Telematics (CMT), the world’s latest telematics service provider. The enhanced experience provides drivers with clearer insights into how their behaviors affect their safety and premiums, helping them improve even more behind the wheel.

Safe driving programs like COUNTRY Financial DriverIQ are making a difference in road safety. A COUNTRY Financial analysis found that DriverIQ drivers have lower loss ratios than those who are not enrolled in the program. A separate CMT analysis shows that drivers who engage with a safe driving app are 65% safer.

Built on insights from hundreds of telematics programs worldwide, DriveWell Advance combines proven best practices into CMT’s new app design. Grounded in years of UX research and engagement data, it delivers one of the industry’s most engaging telematics experiences, helping insurers educate, engage, and retain drivers while making roads safer.

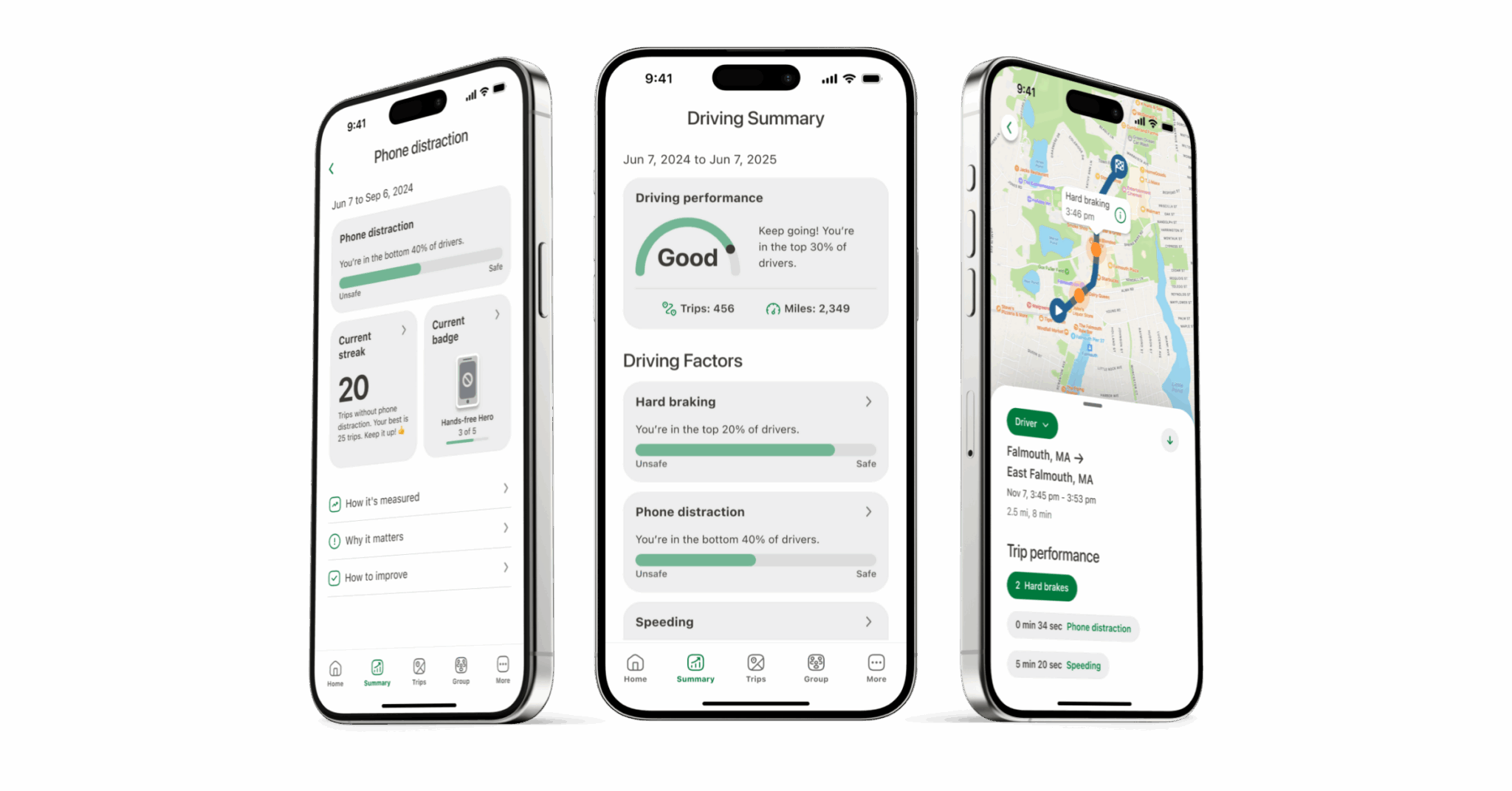

With DriveWell Advance, DriverIQ now features clearer scoring categories, transparent risk breakdowns, and simple tips for improvement, giving drivers a complete view of what affects their scores and how to improve. It measures key behaviors like phone distraction, speeding, and hard braking to provide a holistic picture of driving risk.

The update also enhances the app’s engagement features, including Driving Groups that promote friendly competition based on specific behaviors like speeding or phone distraction.

“DriverIQ has been a powerful tool in helping our drivers understand how their habits affect safety and risk,” said Jeff Riblet, COUNTRY Financial. “By introducing CMT’s DriveWell Advance, we’re giving our policyholders an experience that will help them improve their driving, make a meaningful difference on the road, and take control of their savings.”

“The updated DriverIQ program will deliver a more personalized experience that helps drivers understand their behaviors, improve safety, and strengthen their connection with COUNTRY Financial,” said William V. Powers, Co-Founder and CEO of Cambridge Mobile Telematics. “We’re excited to deliver this improvement that helps make COUNTRY Financial’s drivers safer, reducing risk for their families and communities. Together, we’re creating a future where every trip is safer and every driver is empowered to make a difference.”

About COUNTRY Financial®

COUNTRY Financial provides insurance and financial services to clients in 19 states. Founded in 1925, the company offers a wide range of products and services that help clients protect what matters most and plan for the future.

About Cambridge Mobile Telematics

Cambridge Mobile Telematics (CMT) is the world’s largest telematics service provider. Its mission is to make the world’s roads and drivers safer. The company’s AI-driven platform, DriveWell Fusion®, proactively identifies and reduces driving risk, leading to fewer crashes and injuries, making mobility safer. To date, CMT’s technology has helped prevent over 100,000 crashes worldwide. CMT partners with insurers, automakers, commercial mobility companies, and the public sector to measure risk, detect crashes, provide life-saving assistance, and streamline claims. Headquartered in Cambridge, MA, CMT operates globally with offices in Budapest, Chennai, Seattle, Tokyo, and Zagreb. Learn more at www.cmt.ai.