The Fair Value Webinar Review

Watch the replay

If the video doesn’t load, please update your cookie settings.

Read the full Consumer Intelligence presentation

Consumer Intelligence CEO Ian Hughes presented insights from the UK market during the webinar. You find the full report here.

Top 5 data points from the webinar

6X.

The gap between the top-ranked motor insurance quotes and the average quote on PCW increased by 6X from March 20, 2021 to December 21, 2021.

85%.

85% of the motor products raised their prices in January by more than 2%. 55% raised prices by more than 5%.

27%.

The number of offers on PCWs has increased by 27% — to up to 140 from April 2020 to December 2021.

2 to 9.

In the last 5 years, the number of top-ranked insurers on PWC has grown from 2 to 9.

£30.

It takes a £30 difference — either negative or positive — between current and renewal price to trigger “shop mode.” A £50 difference triggers “switch mode.”

Key insights from the webinar

Shopping behaviour triggers are not what we think

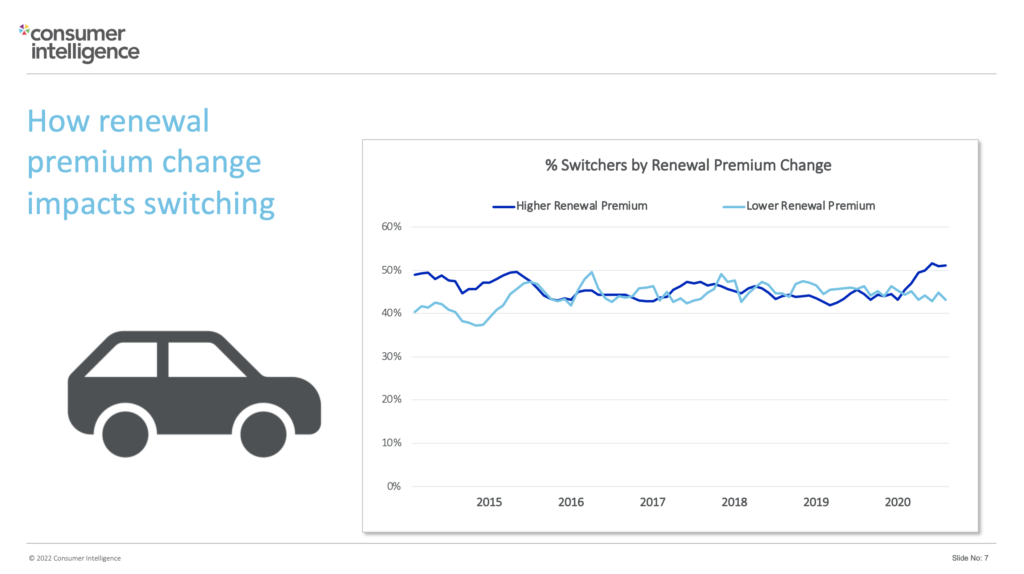

The assumption is that when consumers see a higher premium at renewal they start shopping around. Until the end of last year, the trend was the exact opposite. When consumers saw a lower price, they were more likely to shop around. So, increasing prices doesn’t mean consumers will switch more.

In 2018, there was a spike of shopping and switching. This spike happened because the FCA introduced the requirement to show the previous price alongside the renewal notice.

Today, renewal prices are rising, but new business prices are rising faster. This traps consumers. They have sticker shock on their renewal prices. They go to PCW to find an alternative. But, they find the new business prices are even higher.

Once trapped, consumers will switch for very little. One person switched for 10p.

It will take time for drivers to adjust to GIPP prices

Price walking has created the perception that insurance prices are unfair. Now, we need a period of adjustment. Consumers will realise the regulation does not necessarily mean renewing customers can’t be charged more than first-time customers.

Consumers could see their price increase as a result of inflation and underwriting changes. But they could also see price increases from changing their car, a recent or old crash, address or income variation, etc.

But the UK motor insurance market is very transparent. Where else would you see 140 responses for one quote?

Consumers will be less likely to shop around.

There are many factors influencing buying behaviours. Some of the most recent include: outworking of covid impacts, low driving rates and falling prices, underlying claims inflation, wider consumer confidence, and affordability issues. Reduction in incomes in the UK will have a bearing on consumer behaviour.

For the last decade, the shopping behaviour has been solidly established. Over time, we expect the benefits of switching to reduce. Especially switching based on a new business discount.

There are short- and long-term strategies to respond to the regulatory changes

The regulation is on each product, not on the organisation as a whole. So, in theory, we should see a spike in new business prices.

Adjustment in profitability assumes that the organisation has accumulated a back book where the distortion in prices between renewal and new business prices has become the economic model it relies on.

For those insurers, what we are seeing is a rapid increase in the creation of new products and prices to protect themselves. At least for the next 12 months.

This is short-lived. What does good pricing really look like? It means increasing accuracy. To do that, insurers have had to acquire the best teams, build the most powerful tools, and most importantly, access the best data to define the risk.

Telematics data and the assorted insurance models are an essential tool

The regulation alone will not become a trigger for all drivers to switch to telematics. A lot of insurers have yet to catch up with the benefits and new capabilities of the technology. The purchasing behaviour is changing — but not rapidly. The biggest enabler for change is consumer confidence, finding ways to gain customer trust in telematics.

Drivers don’t enjoy shopping for insurance, but some really enjoy recording and sharing running or cycling data. Focusing telematics on price and insurance ignores the opportunity to gamify the experience and use it to improve driving safety.

As people struggle with rising energy prices, they will look for solutions to reduce their expenditures. This is a great time to use different approaches — such as usage-based insurance with gamification, creating a positive incentive for change, not just a regulatory response.

The perception of telematics is changing

Usage-based payments are standard for many industries. For example, every utility provider bases payments on how much consumers use them. It’s the same idea with usage-based insurance and driving. There is an assumption that consumers don’t want telematics. But, insurers offer consumers over 25 years old telematics just 15-20% of the time.

People are far more aware of their data and the value it holds than 5 years ago. GAFA captures people’s usage data to sell back advertising. Telematics uses data to improve driving behaviors, save lives, and show drivers how safe they are. Telematics can save them money.

Telematics in insurance is transparent. Drivers get something positive as a result. The more people see telematics propositions as a good thing, the more they will come around to the idea.

As one of the panelists said: Telematics is a much fairer way to calculate price than asking people questions.

The DriveScore model offers a breakthrough for telematics

Expensive hardware prevented the mass market adoption of telematics in the UK. Plus, talking about “black boxes” sounds scary for consumers. That’s changed today with low-cost data sources like IoT devices and smartphones.

With more data sources available to insurers, telematics has a lot of room to grow in the UK. However, telematics has been the exclusive domain of young drivers for decades. They were priced out of other options. The rest of the market did not see benefits.

This is changing with DriveScore. With DriveScore, consumers see their driving behaviour before they choose to pass it on to insurers. The data is private. And the data theirs until they choose to share it. DriveScore is giving everyone the protection they need to be confident when they share their data.

Insurers need to demonstrate value and how it is defined

The new regulation sits under the Fair Value umbrella, not just fair price. This falls under the “consumer duty” for all financial services to provide long-term value.

Price changes now require a justification. Usage-based insurance provides a data-driven explanation of why renewal prices change. It’s based on fair observation of the driver’s own behaviour.

Regulation tightening is done for a while

The panelists think the FCA won’t make new regulatory changes for the next 3 years. This is because there haven’t been any fines from the current regulation. “Fair Value” will only be fully defined when an insurer has been fined. The panelists expect this could happen in the second quarter of this year.

It’s too early to tell if the FCA’s GIPP regulation has reached its goal. However, it has clearly made insurers think differently about their pricing strategies. It’s also shown that regulators are ready and willing to influence pricing if they see something unfair.

The regulation has also influenced insurers in how they look at their business models, and how they approach the market in terms of product design, distribution, and their relationship with PCW.

Comments? Want to learn more?

If you have questions or feedback on the webinar, or if you want to learn more about telematics, contact:

Thomas Hallauer

Director of Marketing, Europe

thallauer@cmtelematics.com