To Attract the Masses, Pay Per Mile Car Insurance Needs a Rethink

Having endured various states of lockdowns across the globe, it is perhaps obvious that people from all walks of lives have wished their auto insurance policies were based on how much they actually drive now more than ever. Pay per mile car insurance (also known as Pay-As-You-Drive, or, PAYD) was one of the first Usage-Based Insurance models, starting as early as 2005, but it has never attracted as much attention until recently. However, while some insurers like ByMiles in the U.K. have seen above-average acquisition, the rest of the PAYD market offering in the U.S. has remained curiously stable.

Over the past few months, we at CMT have spent even more time talking to our partners and have realized that the model attracts a wide range of personas, not just the low-mileage Sunday drivers! PAYD is in fact very attractive to infrequent drivers, like those sharing a car, young drivers, drivers that do not commute, those whose mileage varies a lot, or simply the segments of drivers who are trying to save on insurance premiums.

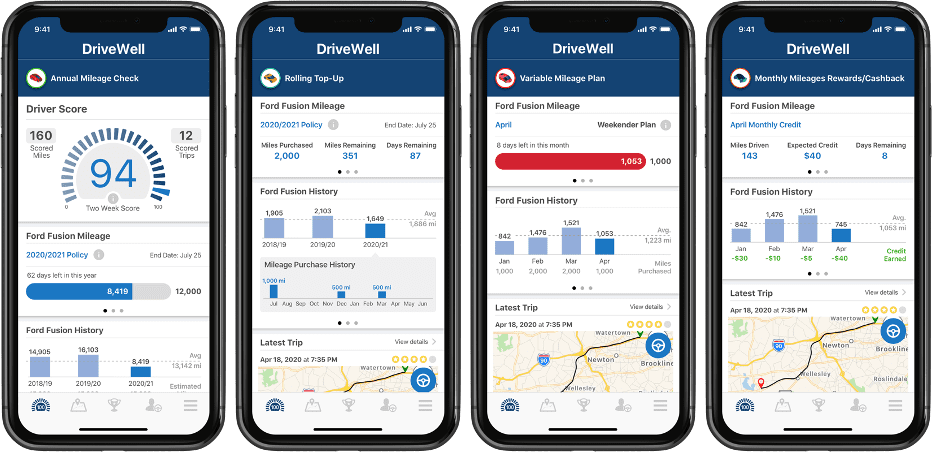

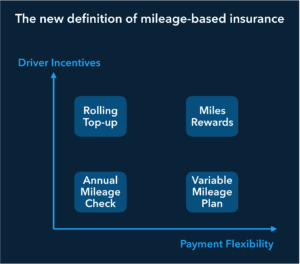

For many of these segments, today’s PAYD models have historically proven to be unattractive. But as the demand for distance-based insurance continues to rise, we are looking at new value propositions by (1) introducing a choice of models that may incorporate varying degrees of incentivization and flexibility. And (2) examining the option to integrate behavior-based pricing into a mileage-based program. This has led us to closely consider four new models, detailed below.

Each program provides a different degree of payment flexibility and incentives.

- Incentives can be offered at renewal or throughout the contract period based on mileage and/or behavior.

- Flexibility can vary depending on the presumed risk of the driver and direct whether payments are upfront for the duration, pre-pay per month or even monthly post payments.

1. Variable Mileage Plan

At onboarding, the drivers pay a fixed annual subscription and choose their monthly mileage plan. At the end of the month, they can choose to stay on the same plan or to change. If they drove less than their plan included, the miles can be carried over, but if they drove over their plan, the miles are taken from the next month and they are put on the higher plan.

Following the first year of driving, an element of behavior can be included in the calculation of the annual subscription.

Driver Advantage: Allows for great seasonability in mileage needs.

Insurer Advantage: Enables carrier to provide PAYD to any driver, not just low-mileage drivers.

2. Rolling Top-Up

At onboarding, the drivers pay a premium including a set package of miles of their choice. Once they run out of miles, they can top up. There are no annual renewals, and the top ups continue as long as the drivers want.

Additionally, in order to engage drivers, insurers can opt to calculate the top-up costs based on the driver’s behavior score, or even offer rewards.

Driver Advantage: Very low cost of entry and coverage proportionate to changing needs; very flexible as there are no fixed contract lengths

Insurer Advantage: Powerful acquisition tool, ideal for young drivers

3. Monthly Miles Rewards/Miles Cashback

At onboarding, the drivers pick a fixed annual mileage contract and the premium can then be paid at the beginning or end of each month. A reward or cashback is then attributed to the drivers each month they drive less than their designated threshold. If they drive consistently above the threshold, the driver may be charged extra or given the choice to end the policy when the initially agreed mileage is reached. At renewal, their new initial fixed mileage contract can be priced according to their score during the previous year.

Driver Advantage: Post-pay program, plus great incentives to drive less and more safely

Insurer Advantage: Very safe program with a strong incentive hook

4. Annual Mileage Check

At onboarding, the drivers pay the premium monthly, or annually, including an agreed annual mileage estimate. The app then monitors the mileage throughout the contract period. At renewal, the insurer tallies the mileage driven and the contract. The insurer can then decide to offer cashback on renewal or rewards if the mileage driven is lower.

Driver Advantage: Very straightforward program with good value

Insurer Advantage: Great entry-level mileage-based program

These are value propositions for the next decade of PAYD insurance, but drivers’ demand is here now. Creating and deploying a new insurance concept would be risky if drivers had to be taught from scratch. However, the U.S. market is very aware of connected insurance and the above models match what most – if not all – drivers already encounter with various cellular providers.

Revolutionizing PAYD may be a triathlon, but as industry leaders in smartphone telematics, CMT knows that the first one to dive in has the best chance to win. Work with us to stay on the cutting edge of technology-enabled business models that maximize the benefits of connected insurance.

To continue the conversation of the future of distance-based programs, contact us now!