Learn the True Story of a Crash with Smartphone Telematics

Does the driver need help? When did the crash happen? Where did the crash occur? How severe was it? Is it a total loss? These are just a few of the questions insurers need to investigate after a crash. However, it can take weeks of phone calls, assessments, triaging, and storage and rental fees before the insurer has everything it needs to begin resolving the claim.

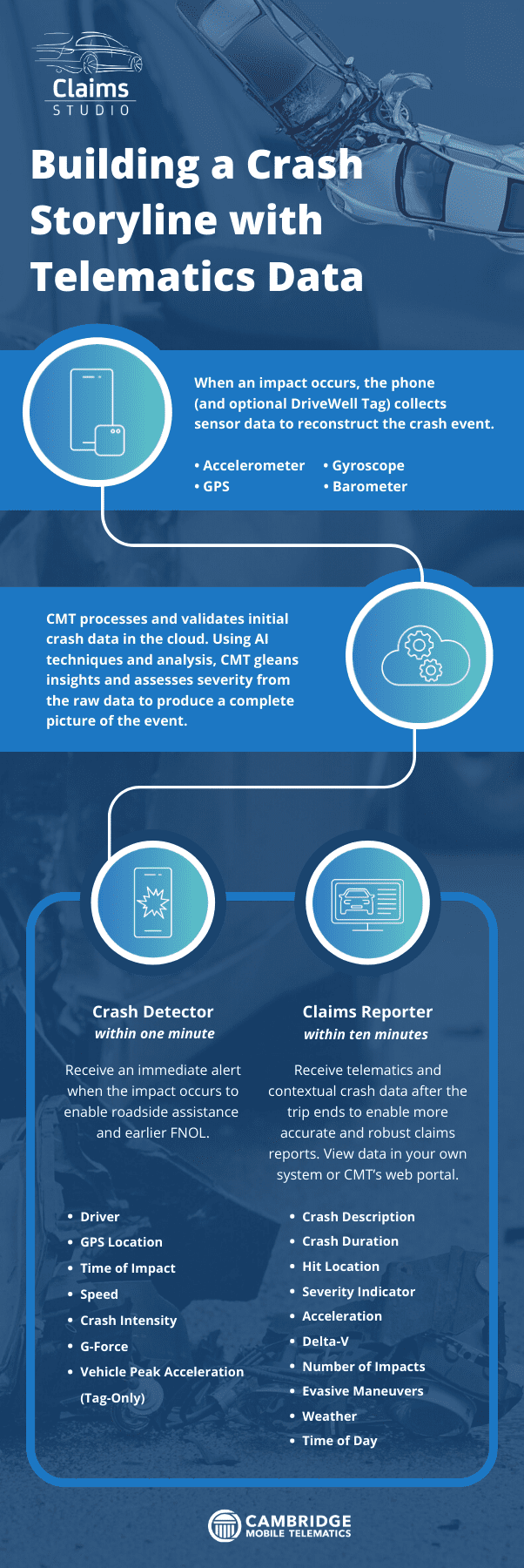

Based on the smartphone, Claims Studio transforms the end-to-end claims process with unbiased and contextual crash data available soon after an impact occurs. Starting with real-time notice of a crash, Claims Studio tells insurers what they need to know to make informed decisions until the claim is settled. Claims Studio is seamless to integrate into a business and simple to deploy to policyholders. Yet the results are the same no matter how it’s implemented – increased customer satisfaction, faster time-to-resolution, improved claim report and repair cost accuracy, and reduced fraud and costs.

Here’s how it works:

Are you ready to use smartphone telematics in your own claims operation? Contact us and a member of our team will reach out!