Adapting to Changing Trends in the Insurance Industry

Last week CMT attended Connected Car Insurance USA in Chicago. Our VP of Insurance Ryan McMahon presented about factors changing and innovating the insurance industry. If you missed it, he started by discussing a link between smartphones and insurance losses.

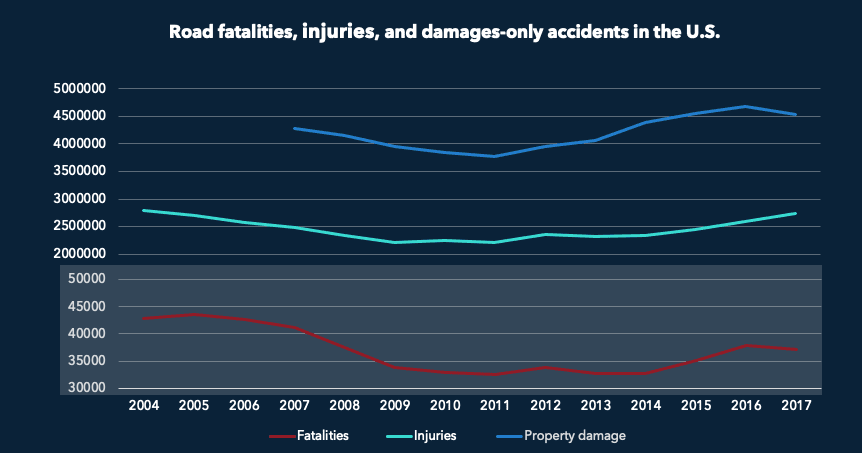

In 2004, roads were becoming safer in the U.S. The improvements were promising – road fatalities, injuries, and damage-only accidents were significantly decreasing. However, after a long trend of positive change, and despite improvements in car safety, road fatalities, injuries, and damage-only accidents began to rise again.

What is contributing? The smartphone.

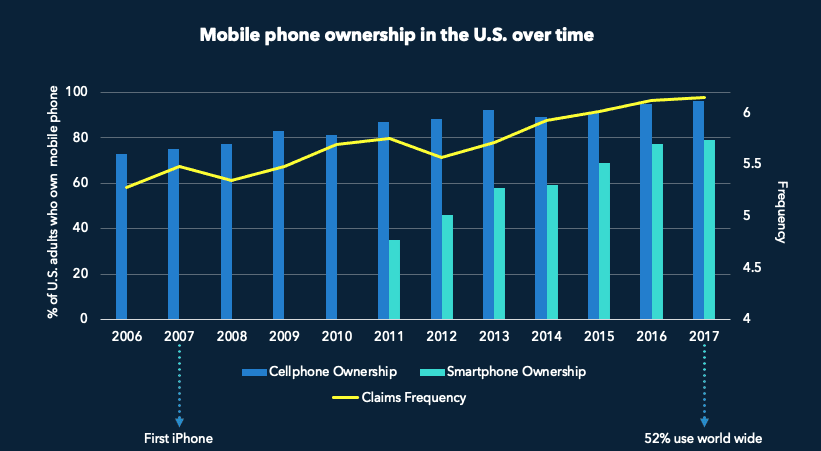

Decreasing road safety is reflected in the rising number of claims reported and phone ownership. This indicates a strong correlation between road accidents and phone use behind the wheel.

Not only is phone distraction negatively impacting road safety, it is also negatively impacting the insurance industry. It is affecting insurers’ financial results and they cannot differentiate between drivers inside a regular book of business. Fortunately, there are additional technology-powered changes that are innovating the insurance industry for the better.

One change is distraction can be reduced with the right incentives. For example, CMT partners with insurers and municipalities on Safest Driver contests. With participants competing for cash prizes, the contests have seen significant reductions in phone distraction.

- Boston’s Safest Driver – 47% reduction in phone distraction

- Seattle’s Safest Driver – 35% reduction in phone distraction

- San Antonio’s Safest Driver – 29% reduction in phone distraction

Upcoming presentations

- September 18th – VP of Insurance Ryan McMahon @ Connected Claims Europe

- September 24 – CTO and Co-founder Hari Balakrishnan on stage with SoftBank @ InsureTech Connect