Marmalade Introduces Pay as You Go Auto Insurance Solution

Originally published in Insurance Business UK, 12/4/2020

Insurance provider Marmalade has launched a new “pay as you go” auto insurance to help young drivers save even more on their premiums.

The new offering will allow drivers to pay specifically for the miles they use on a vehicle where they are not the main named driver. A release said that the policy is the is the most cost-effective for drivers covering less than 3,500 miles per year.

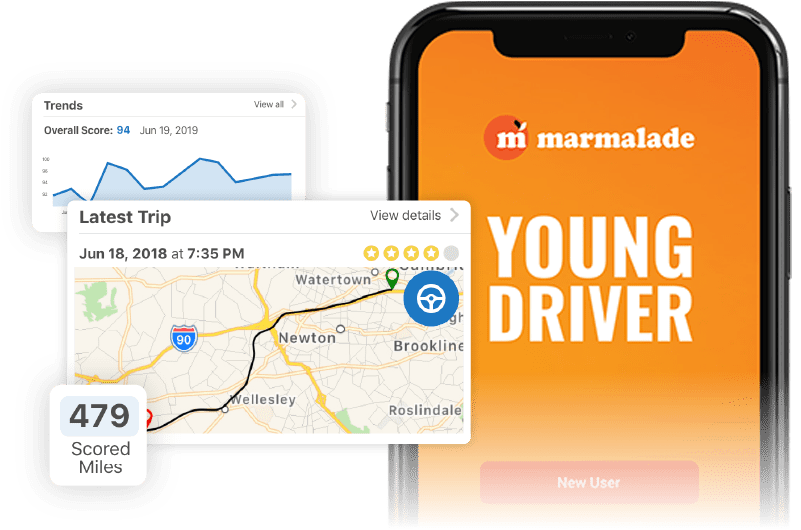

Marmalade will track and record drivers’ miles driven using its proprietary “App & Tag” system, which leverages smartphone telematics technology. The policy is underwritten by Ageas Insurance, and will feature an initial package of 500 miles for £195. It will also include an automatic top-up of 100 to 500 miles when the driver has 50 miles remaining – this top-up costs less the safer the policyholder drives.

Drivers can keep track of their miles on their app and even earn a “no claims discount” for each year without claims, Marmalade added.

“We have built this new offering in response to the demand from young drivers who want the freedom of a car, but either can’t afford to pay for their own or simply can’t justify having their own vehicle,” said Marmalade CEO Crispin Moger. “Our customers want flexibility and an offering that is dynamic and can fit their needs without costing more than is necessary, something they may often find when being added as a named driver to ordinary policies on family cars.”

Moger added that annual mileage driven has been on the decline, and that the younger generation has been driving less – refraining from purchasing a vehicle of their own. The CEO also cited Marmalade’s records, noting that 74% of customers have driven less than they would in 2020, and 47% had indicated that they expect to drive 4,000 miles or less in total across the year.

“As a solution to the changing demand and in response to our findings, this policy allows drivers to be insured on the family vehicle and only pay for what they use, it’s completely independent to any existing insurance on the car and still qualifies the user to build up their own no claims discount helping them to get cheaper car insurance when they do reach a need for a full-time vehicle,” said Ageas director of distribution Russell White.