CMT's New Report Confirms Increasing Appetite for Connected Insurance in Europe

Interest is up 32 percent in four largest motor insurance markets thanks to changing driving patterns during COVID-19

LONDON–(BUSINESS WIRE)–A large shift in driving habits due to the COVID-19 pandemic has changed how people think about motor insurance across Europe, according to a new study by Cambridge Mobile Telematics (CMT), the world’s leading mobile telematics and analytics provider.

Based on the surveys of 4,000 drivers in France, Germany, Italy and the U.K., the new report shows shifting attitudes towards quoting channels, claims services, pricing models and value-added services, broken down and analysed by location, age and driving behaviour.

The two surveys – taken in January 2020, before the pandemic, and then nine months later in September 2020 – reveal up to 81 percent of the drivers in Europe have changed how they drive because of COVID-19. Now 65 percent are interested in connected insurance, a 32% jump in nine months.

The pandemic has modified commuting patterns and the average drivers now on the road are much younger, a traditionally riskier driving population. With fewer viable public transport commuting options, younger generations are getting behind the wheel to get to work.

Each country lockdown impacted drivers differently. In the U.K., 66 percent of the respondents said their driving patterns changed and that they are now driving less. 29 percent also noted that they drive for different reasons, and on different days. In France, however, the majority (57 percent) have not really changed driving habits, 12 percent even suggested they drove more.

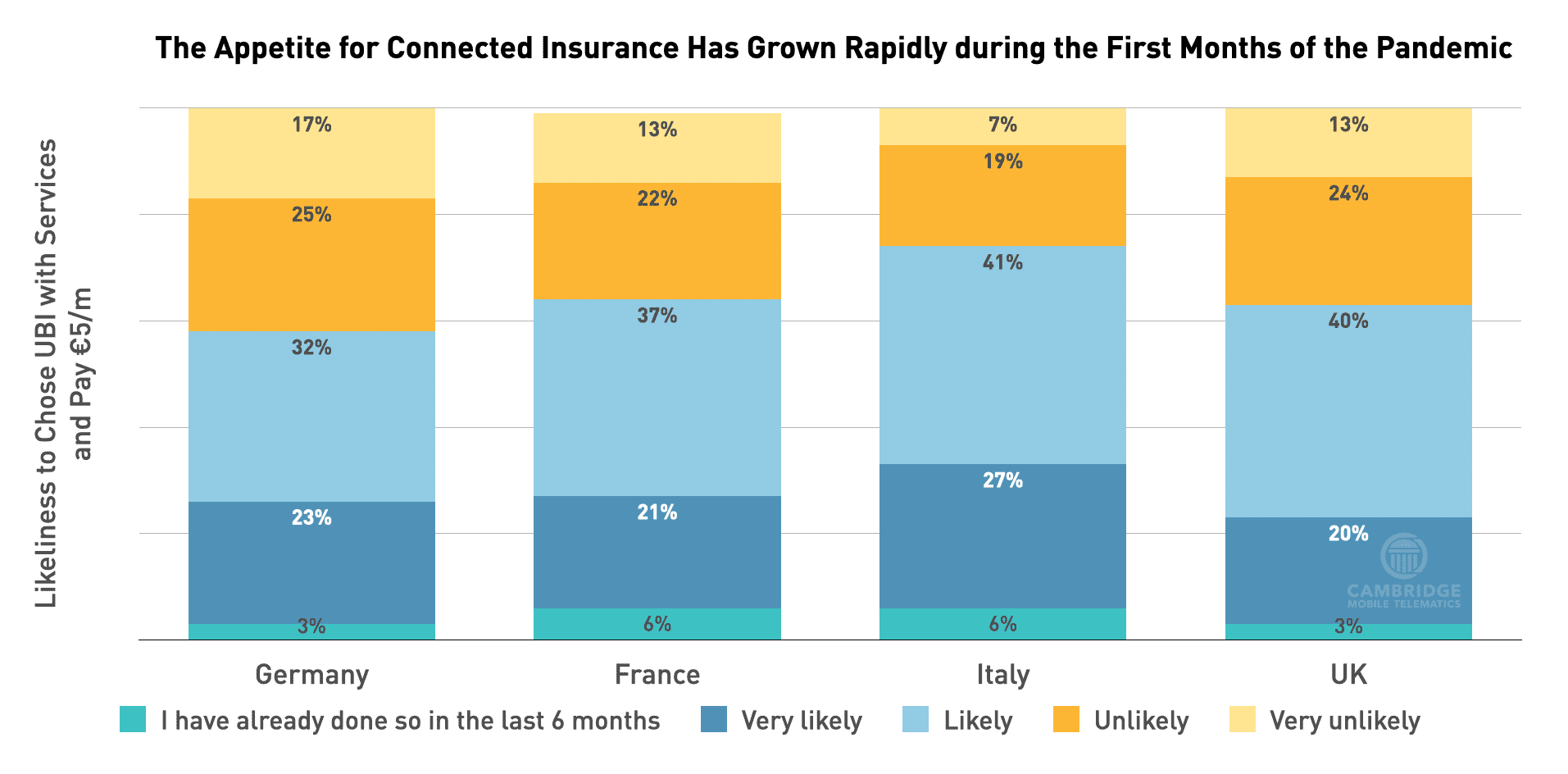

In this context the survey asked respondents about their preferences in terms of quotes, purchase, claims and motor insurance price models. When asked whether they would be likely to switch to behaviour, distance or reward-based insurance, the September survey showed a major shift in drivers’ expectations.

Respondents were overwhelmingly in favour of switching to usage-based insurance (UBI) at the next renewal if the offer was present. Italian drivers were the most likely at 74 percent of the respondents. 63 percent of British and French drivers were ready to switch, and German appetite for connected insurance grew from 47 percent to 58 percent of drivers willing to switch in the nine months between both surveys.

In the full 50-page report you will find:

- An analysis of the changes in behaviour relating to driving, pricing, buying, and claiming in four European countries by age, gender, type of roads, and premium paid

- An overview of four markets’ readiness and appetite for connected insurance and digital claims

- A breakdown of the top value propositions used today, and how preferences have changed since the onset of COVID-19

“The pandemic uncovered challenges few could have predicted. As a result, typical risk models are no longer enough,” commented Ryan McMahon, VP of Insurance & Government Affairs at CMT. “As driving behaviour changes, the ability to predict risk needs to evolve, insurers will find this report can help identify which European drivers to target with new products.”

The Best Connected Insurance Value Propositions for Europe report is available to downloaded from today.

About Cambridge Mobile Telematics

At Cambridge Mobile Telematics, we show up every day to achieve one goal: to make the world’s roads and drivers safer. Founded in 2010 based on MIT research, we are now the world’s largest mobile telematics provider, powering 65 enterprise programs in more than 28 countries. Our technology serves several million drivers a day through our partnerships with leading insurers, rideshares, cellular carriers and car makers. We deliver cutting-edge technology to solve the most important problems facing mobility today and to improve road safety across the world.

To learn more, visit www.cmtelematics.com and follow CMT on Twitter @cmtelematics.

Contacts

Thomas Hallauer

Cambridge Mobile Telematics

thallauer@cmtelematics.com

Originally published on the Business Wire, February 25, 2021