Premium Score

Risk Factors

Built on millions of trips and billions of miles over six continents, Premium Score captures driving behaviors that are truly indicative of crash risk.

Premium Score

Receive an accurate assessment of driver risk for loss prediction and pricing

Seamless filing process

To simplify the state filing process for insurers, CMT has filed Premium Score with Departments of Insurance across the United States. It’s currently approved in 49 states for personal and commercial lines.

Best-in-class actuarial model

Segment the riskiest and safest drivers with an actuarial model built exclusively on telematics-based factors that predict a driver’s risk of collision.

How Premium Score works

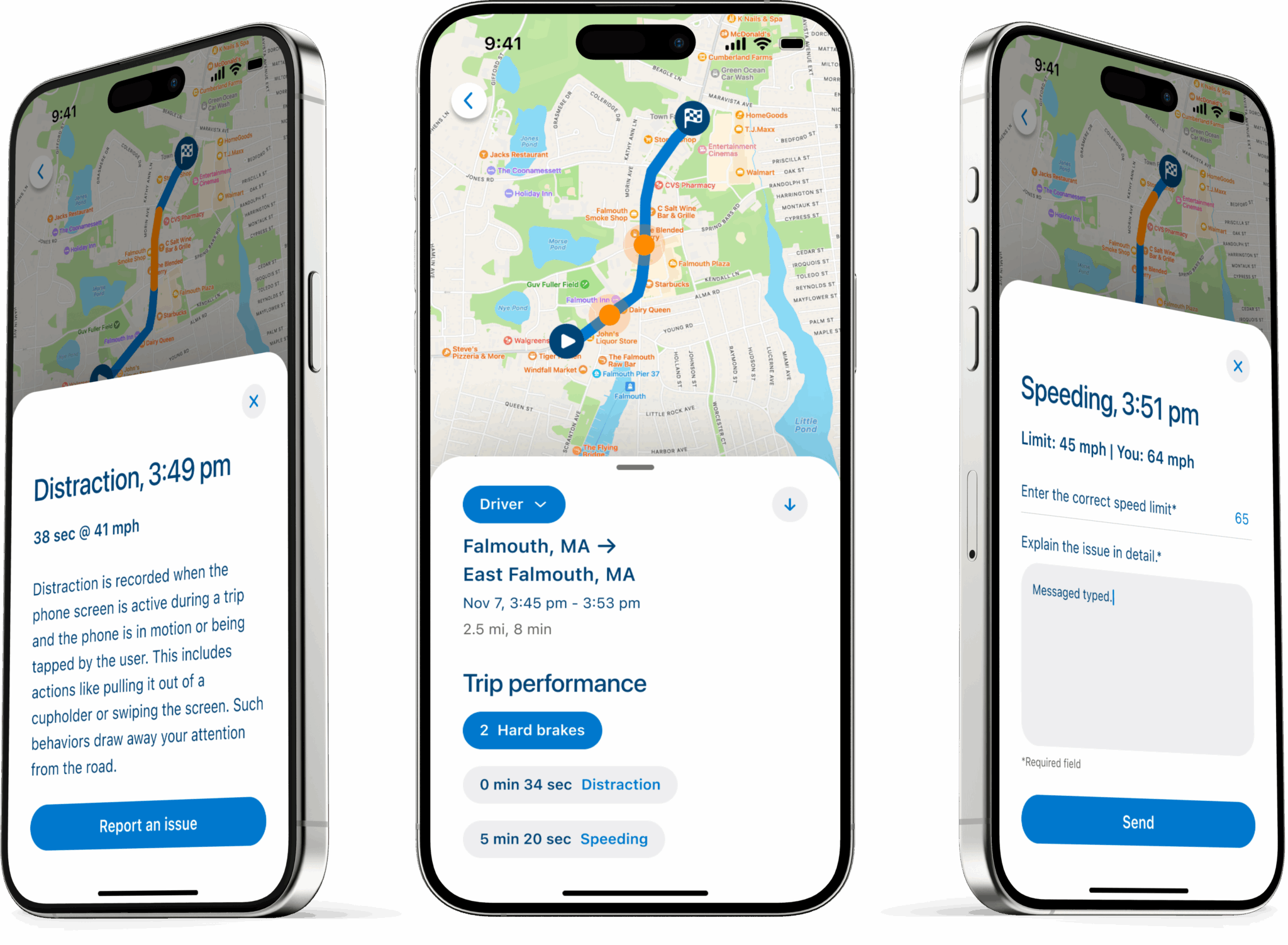

Changing Driving Behavior

Surface in-app actionable feedback to improve driving behavior

Less risk and costs

Help your drivers understand their risky driving behaviors and motivate them to improve with transparent and frequent feedback on their driving behavior.

Flexible scoring

Choose from a number of scoring options based on your program.

How in-app scoring works

Solutions Enabled