Telematics Insurance: How to Get Started in Europe

In Q1 2022 in the US, telematics adoption jumped 30%. The number of customers that were offered a telematics policy rose from 32% to 40% and the number who opted in rose from 49% to 65%. This increase shows that the 2-year acceleration trend that we have seen in the US market is only strengthening.

Meanwhile in Europe, only half of the Top 10 insurers — outside Italy — even have a telematics offering. Too many still believe the opportunity is unclear and the technology immature.

However, all the signs in Europe point to rapid growth in telematics awareness and appetite — from both drivers and insurers. We’ve run consumer surveys for the last 3 years to identify the evolution of the European market potential. In our latest edition, we found that 65% of drivers in Europe would say yes to UBI. This is matches the latest US rates.

Perhaps more surprising is that 66% of French drivers would also be interested in UBI.

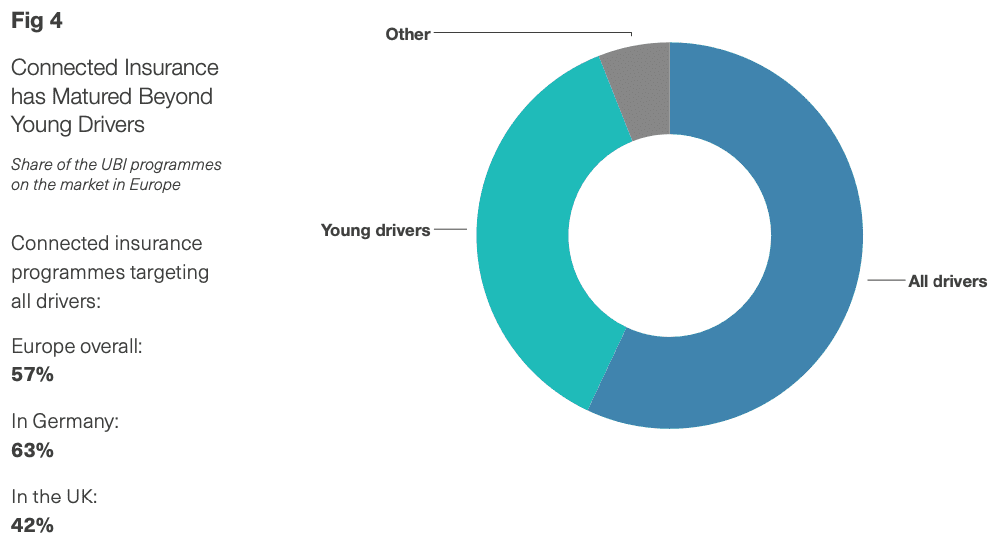

France has the lowest UBI penetration today. The fastest growth is not coming from the UK, but in Germany where they will reach 1 million “Telematik Tarifs” this year. In part, this is because 7 the Top 10 insurers have a UBI program. It’s also due telematics being designed for all drivers, not just the riskiest.

In our latest report on the European connected insurance market, we have statistics on premiums, consumer demand, offer types, and model options. We’ve also included feedback and case studies from insurers running successful programs, and key strategies to start your own.

The report shows how insurers are successfully deploying telematics insurance. This includes measuring the benefits their drivers are getting, as well as identifying the impact of telematics on pricing, retention, and claims costs.

Download Getting started with connected insurance today.