Enhance Operational Efficiency of Your Claims Organization with Telematics

Today, about 65% of the total cost of loss adjustment expense is tied to labor. Smartphone telematics can fundamentally change the process by which claims are adjusted.

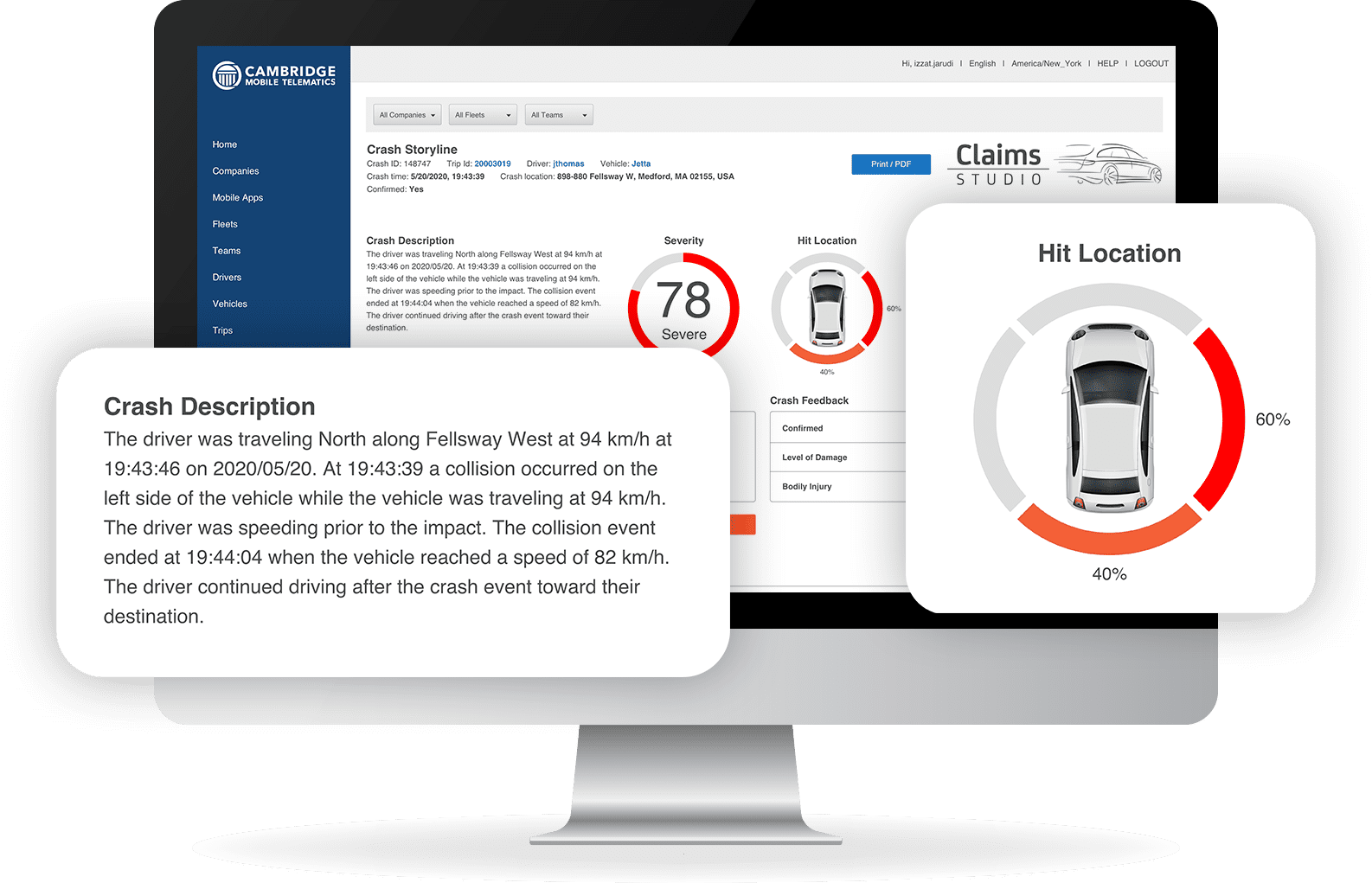

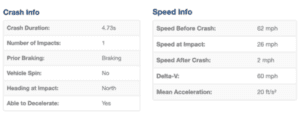

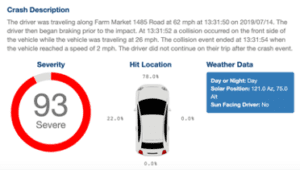

Smartphone telematics is an inexpensive way for insurers to gather critical and objective crash details in a timely manner. Telematics combined with artificial intelligence produces key information, such as where the crash occurred, its severity, hit location on the vehicle, number of impacts, speed and acceleration details, evasive maneuvers and time of day – all within minutes of the crash occurring.

Accessing a comprehensive story of a crash early in the claims process reduces the number of steps it takes to resolve the claim. Insurers that integrate telematics into their claims management system will improve their operational response, lowering labor costs without adversely affecting indemnity. Properly executed, telematics will change the price of auto insurance and allow insurance carriers to gain market share.

Below is a number of ways insurers can increase efficiency in claims following a crash, thanks to telematics.

Effective Claims Triage

Quick and accurate facts of loss enable claims organizations to route claims to the proper internal departments early in the process. For example, telematics data like speed, number of impacts, delta-v, and airbag deployment will recognize injury potential and severity, indicating if the claim should be channeled to specialized bodily injury adjusters.

Accurate Loss Assessment

Understanding the context and severity of the crash help adjusters estimate the potential for total loss of the vehicle or if it can be sent for repairs – prior to sending an appraiser to the scene. Claims representatives will make more accurate vehicle repair decisions as they can recommend the vehicle to a preferred repair shop most qualified to handle the damage.

Appropriate Repair Network

Connecting policyholders with the right vendors at the scene reduce multiple vehicle tows and needless costs. Instead of the policyholder selecting an out of network repair shop that could overcharge the insurer, the insurer can direct the vehicle to a reliable location within its network. In the case of a potential total loss, proper towing avoids unnecessary storage fees by sending the vehicle to a facility equipped to quickly verify if it’s a total loss. Speeding up this process gets the driver in a new vehicle faster, preventing weeks of rental fees.

Productive Investigation

Because insurers are aware of a potential crash within minutes, they can proactively reach out to customers at the appropriate time to start the investigation early. Adjusters can reduce their investigation times by using vital crash info to verify what happened instead of conducting multiple interviews to collect facts of loss and vehicle specifics.

Fraud Deterrence

When implemented, telematics can be the first line of combating fraudulent claims. For example, the number of impacts and where they occurred on a vehicle identifies unrelated prior damage. Quickly discovering conflicting reports lets insurers spend less time and money on fraudulent claims.

Insurers are often deterred by the false perception telematics in claims means roadside service and emergency response. While impact alerts is a valuable service, it’s just one way insurers can use telematics in claims. In fact, connected claims is a set of functionalities with the purpose to make the claims process more transparent, more efficient, and less time consuming for all involved.

Interested in using telematics to improve your operational response? Contact us!