Claims Studio: Reconstruct and Detect Crashes

Cambridge Mobile Telematics is excited to announce our latest product line, Claims Studio. Using telematics and artificial intelligence, Claims Studio will revolutionize the claims process by detecting a potential impact in real time and reproducing the true story of a crash within minutes from unbiased and contextual crash data.

Claims Studio allows insurers to spend less time collecting information and more time confirming facts and accurately assessing loss by introducing key information earlier in the claims process. Additionally, insurers can use Claims Studio to help their drivers in moments of need by receiving an alert immediately following a crash.

Insurers can customize their Claims Studio solution to best fit their business needs, choosing the right products to enhance their customers’ experience and integrating specific crash details into their daily adjuster workflow. Claims Studio’s products include:

Crash Detector provides real-time notification of a vehicle crash to send roadside assistance to policyholders when they need it most. Providing critical details like GPS location, time, and driver identification, Crash Detector enables insurers to save valuable time in emergency situations and improve the customer experience with added services. Plus, insurers can receive an earlier and more accurate First Notice of Loss with immediate crash notifications.

Crash Detector provides real-time notification of a vehicle crash to send roadside assistance to policyholders when they need it most. Providing critical details like GPS location, time, and driver identification, Crash Detector enables insurers to save valuable time in emergency situations and improve the customer experience with added services. Plus, insurers can receive an earlier and more accurate First Notice of Loss with immediate crash notifications.

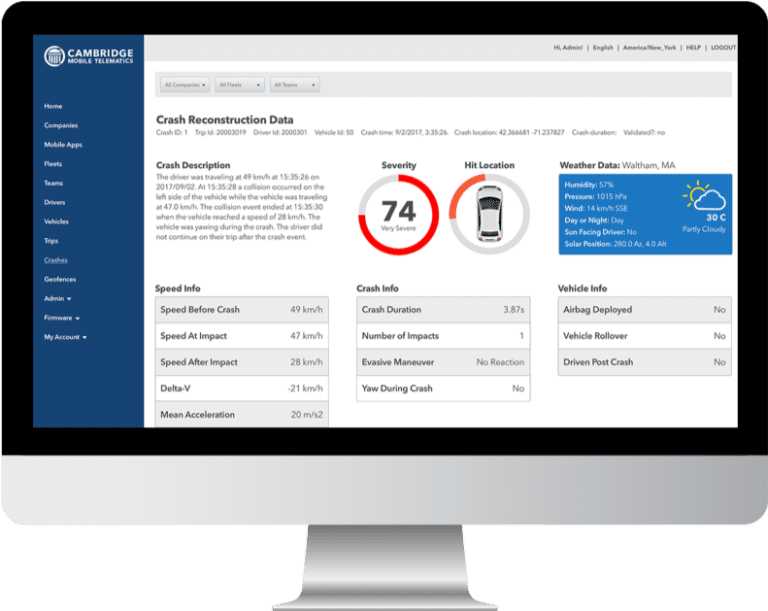

Claims Reporter provides an accurate, unbiased crash narrative in the form of a detailed Crash Storyline in CMT’s web portal or a Crash Data Feed into a claims management system. Details include CMT’s proprietary severity indicator, hit location on the vehicle, speed and acceleration details, evasive maneuvers, and more.

Claims Reporter provides an accurate, unbiased crash narrative in the form of a detailed Crash Storyline in CMT’s web portal or a Crash Data Feed into a claims management system. Details include CMT’s proprietary severity indicator, hit location on the vehicle, speed and acceleration details, evasive maneuvers, and more.

Click here to learn more about Claims Studio and the value it can bring to your business and your customers