News & Insights

News

Cambridge Mobile Telematics Crosses 1 Million Drivers in Japan

July 1, 2025, Tokyo, Japan — Cambridge Mobile Telematics (CMT), the world’s largest telematics provider, announced today that it has surpassed one million drivers on its platform in Japan. Telematics...

July 1, 2025

News

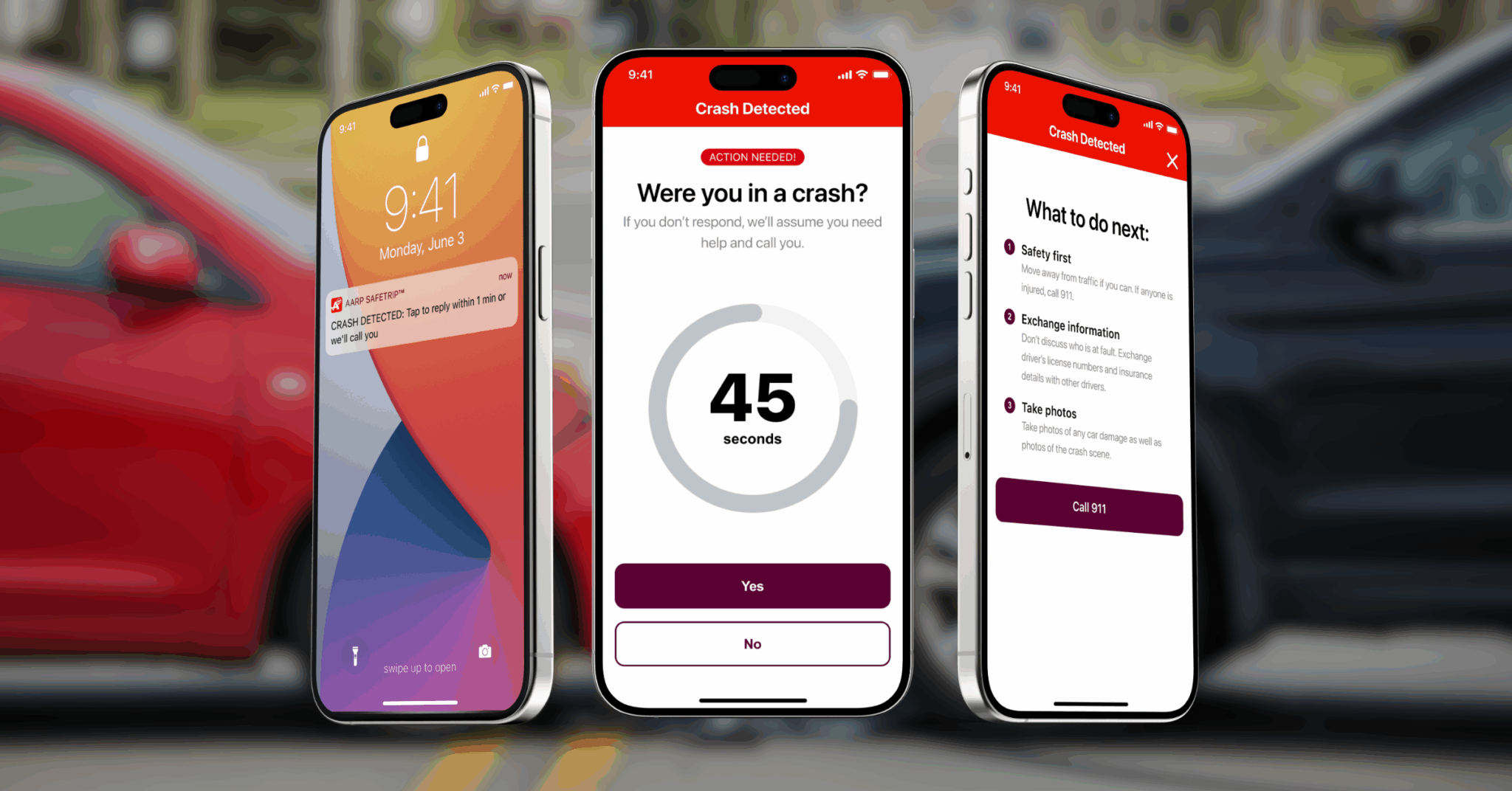

CMT Expands Life-Saving Reach of CrashAssist® with Major New Deployment

Cambridge, MA — June 26, 2025 — Cambridge Mobile Telematics (CMT), the world’s largest telematics service provider, today announced that CrashAssist®, its patented real-time crash detection and emergency response technology,...

June 26, 2025

Distracted driving

Road Risk Alert: Stars, Stripes, and Screen Time. Distraction's up 12% on Independence Day

As the marquee summer weekend, the Fourth of July draws over 61 million drivers to beaches, barbecues, and long weekend getaways. But amid the celebrations, Independence Day remains one of...

June 24, 2025

News

Report Reveals Top Mobile Apps Behind Distracted Driving

Cambridge, MA, June 11, 2025 — In the age of mobile apps, the phrase “distracted driving” extends well beyond texting. A new report, The Most-Used Apps Behind the Wheel, from...

June 11, 2025

News

Cambridge Mobile Telematics’ DriveWell Fusion Named a 2025 World Changing Idea by Fast Company

Cambridge, MA, June 10, 2025 — Fast Company has named Cambridge Mobile Telematics (CMT), the world’s largest telematics service provider, a winner in its 2025 World Changing Ideas Awards. This...

June 10, 2025