Auto Insurance Game Changer #2: Assessing Phone Distraction

While an increase in smartphone ownership has introduced problems in auto insurance, advancements in telematics technology are revolutionizing auto insurance and its role in the mobile world today. This five-part blog series addresses the problems facing auto insurance and the Game Changers solving them.

Game Changer #1: Leveling up with Artificial Intelligence and IoT

Problem: How can insurers account for phone distraction behind the wheel?

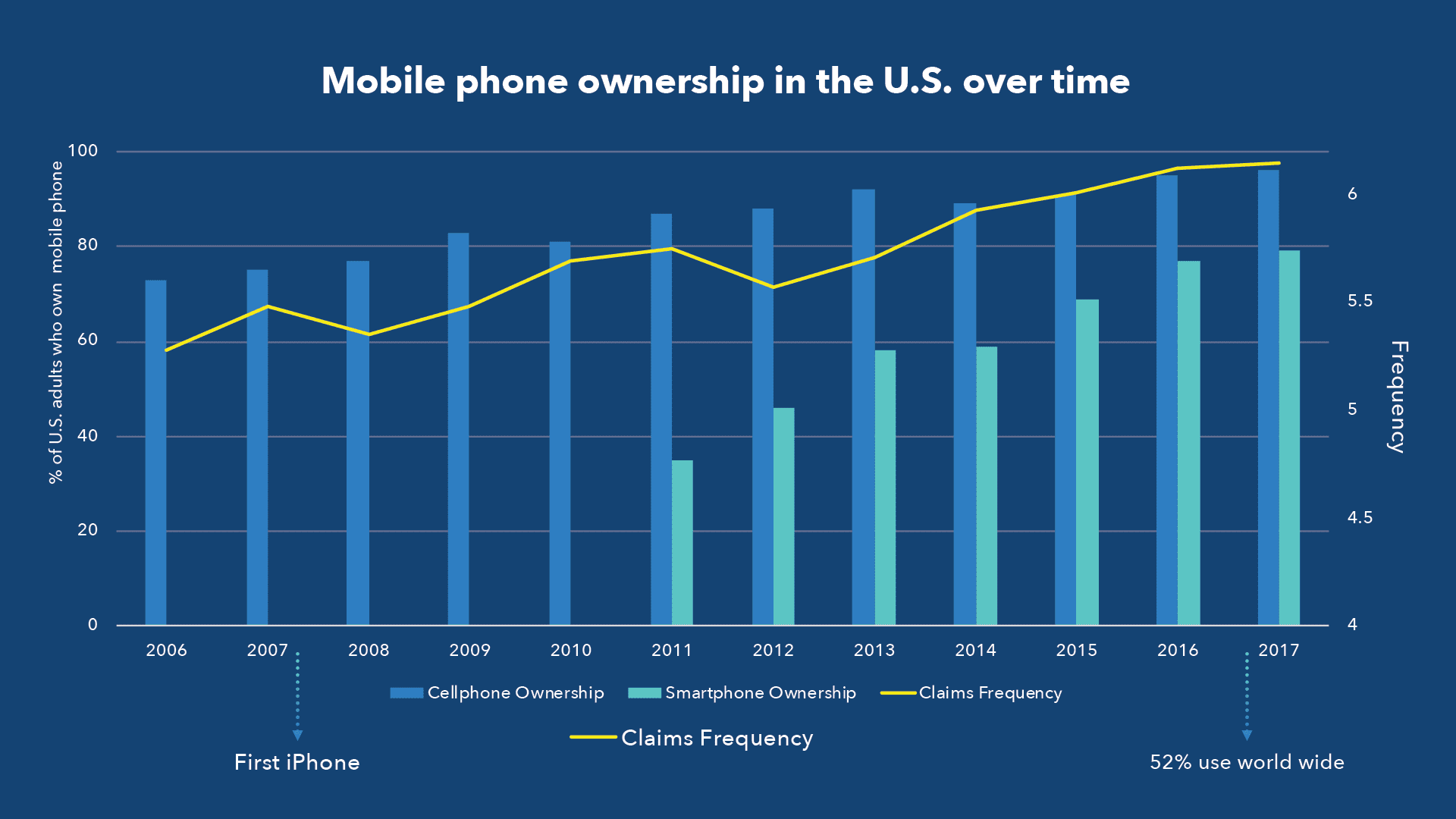

In the United States, claims frequency began to increase around the time of the invention of the first iPhone, and continues to increase today. As drivers become more distracted by their phones while operating a vehicle, the more dangerous roads become. However, phone distraction does not only impact road safety but insurers’ financial results as well.

With smartphone telematics, insurers can use mobile sensing to detect when the driver is using their phone while operating the vehicle. Because phone distraction is more predictive of crash risk than traditional scoring factors, assessing phone distraction enables insurers to better match price to risk. With this information, insurers can then offer discounts and rewards based on phone distraction, as well as other driving behaviors like extreme speeding and hard braking.

In addition to assessing phone distraction behind the wheel, insurers have a more active role in reducing risk with smartphone telematics. Engagement methodologies, feedback, and the right incentives promote driving improvement. This gives insurers an active role in reducing the risk they are covering and drivers an active role in the price of their premiums.

Game Changer: Phone use while driving can be quantified and assessed through smartphone telematics.

Next Game Changer: Methods to motivate safer driving behaviors